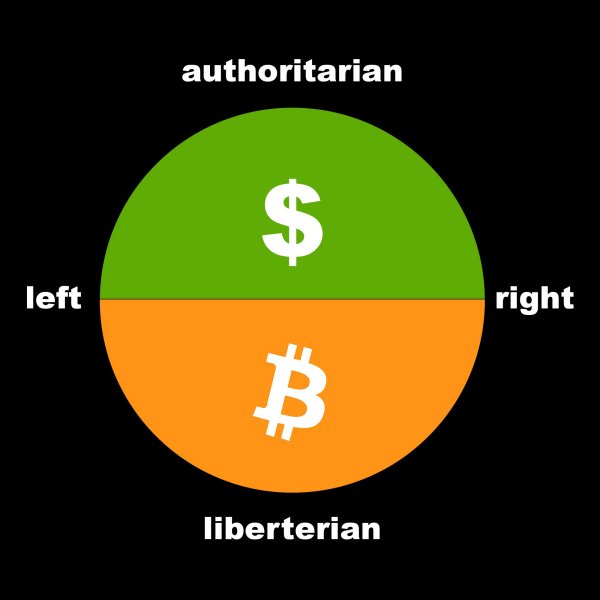

Bitcoin isn’t a right-wing plot, it’s not even political. It’s inclusive by design, despite what critics say.

The energy use of Bitcoin mining is a big concern of people worrying about our environment. How much of a problem is Bitcoin in these regards, and why do some people even claim that Bitcoin is a ‘green’ form of money?

Could China (or any other organized actor) successfully run a 51% attack / majority attack on Bitcoin?

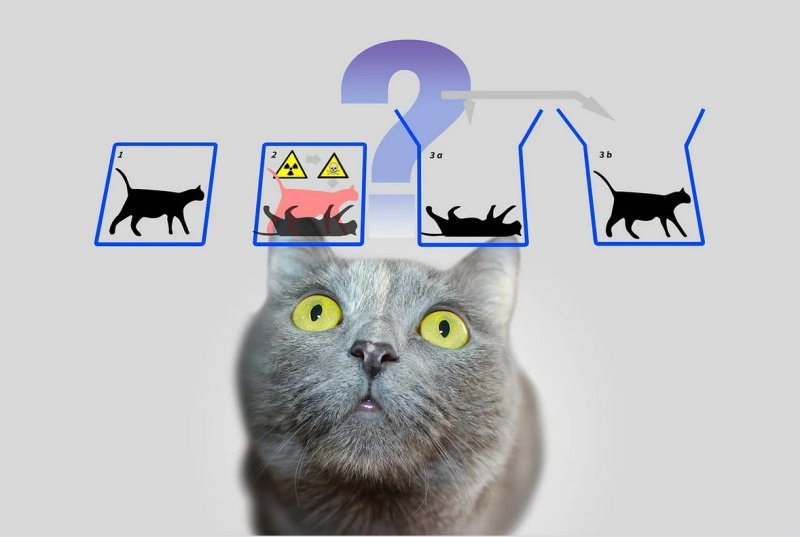

This article explains whether quantum computing may pose a security threat for the Bitcoin system.

Why the idea of a ‘better, improved’ Bitcoin is a fallacy, and how altcoin projects have been capitalizing on it for years.

Bitcoin is not a bubble, but a series of bubbles – find out why that’s a good thing and bullish for Bitcoin’s future.

Will governments eventually ban Bitcoin – and is that even possible? Read to find out more.

Bitcoin usage for illicit / criminal purposes: how much of a problem is that? This article provides some facts about the extent of the problem.

This take – commonly called ‘unit bias’ – is probably one of the most common misconceptions of people hearing about Bitcoin for the first time, but shockingly, even of many who have been active in the ‘crypto space’ for quite a while!

The cause of this misunderstanding basically comes down to a mathematical fallacy. Let’s take a look at the following entry prices by 2 investors. Person A buys 1 ‘full’ Bitcoin at the price of $1,000 back in 2017, while at the same time, Person B only buys 1/10 of a Bitcoin (that’s 10,000,000 ‘satoshis’ – 1 Bitcoin can be divided into 100 million of these smaller units, similar to the ‘cents’ in the US dollar currency):

| 2017 | $ 1,000 | ROI | ann.return | $ 100 | ROI | |

| 2018 | 14,244 | 1,324% | 1,424% | 1,424 | 1,324% | |

| 2019 | 4,093 | 309% | 202% | 409 | 309% | |

| 2020 | 7,462 | 646% | 195% | 746 | 646% | |

| 2021 | 30,323 | 2,932% | 234% | 3,032 | 2,932% |

Do you notice anything?

Yep – the returns are identical! 😀

Regardless how many “fractions” of a Bitcoin you buy – you can ride with its success 1:1.

But you can fine-tune how much of your savings you want to protect by converting it from inflationary Fiat money into sound Bitcoin.

Do it responsibly nevertheless. Today, an investment in Bitcoin can be considered as pretty safe compared to a few years ago, but still: only ‘bitcoinize‘ an amount of Fiat money that you can afford to hold without selling it for at least 2-3 years. That’s still way safer than ‘betting’ on the success of some random altcoin project (that may formally give you more ‘tokens’ per $100, which might play with your psyche a bit – but usually the annualized gains per invested $100 are significantly smaller, especially on a long-term scale).

Financial experts as well as experienced cryptocurrency market veterans recommend the following:

- Decide which amount of your Fiat money you can comfortably put into ‘crypto’ – in other words, ask yourself which amount you can commit yourself to keep untouched for at least a few years. You want to give Bitcoin time to ‘keep its promise’ after all…

- Allocate the majority of this ‘crypto’ portfolio in Bitcoin (at least 85%), avoid more exposure in altcoins. Altcoins are comparable to high-stake Casino bets with very little chance to succeed in the long run. Bitcoin is usually the ultimate life-saver of any ‘crypto’ portfolio, so just make sure it’s large enough to be able to fulfill this function. A large altcoin allocation will most likely cause your portfolio to bleed heavily during bear markets.

So if you are worried about investing in ‘crypto’ in general, simply bet only on the safest horse in the race, only ‘bet’ on it as much as you feel comfortable to put aside for a long time, and then really stick with it (even through bear markets) – instead of throwing in the towel if the hoped-for ‘super gains’ don’t materialize right away. 😉

This strategy should allow you to protect at least parts of your savings from the teeth of inflation and also reduce the devaluation of other capital allocations. It is why experts like to call Bitcoin an ‘asymmetrical bet‘: the risk of loss is relatively small (by investing $1,000 for example, you can only lose a maximum of $1,000), but the upside is so massive that one could very well make up even for strong losses in other sectors of one’s portfolio just by also owning a ‘safe’ amount of Bitcoin.

Good luck with your Bitcoin investment – be it 0.001, 0.01, 0.1 or 1 Bitcoin!

Okay guys, let’s forget for a moment that Bitcoin has surprised and shocked people with its insane increases in price since 2011 (when it hit the markets for the first time) and that people have asked this question since already back then.

Let’s instead play with the idea for a moment that Bitcoin continues to do its thing, and won’t only become a relevant part of the treasury reserves of private citizens and corporations, but gradually also one of central banks, by that approaching price levels of 1,000,000+ (then ‘digital’ CBDC-)USD per Bitcoin. Would that not be the time to say to your partner: “Honey, we really missed the ‘Bitcoin’ train, it’s too late to buy now!” ?

Well if you would only be hunting for quick and instant gains, then it might.

But Bitcoin would still have its qualities of being immutable, inconfiscatable, and uncensorable super-hard money that you can take with you anywhere in the world. Wouldn’t that alone justify allocating at least a little ‘safe play’ part of your wealth in Bitcoin, instead of staying completely exposed to the inflatable and censorable ‘central bank digital currency’ we will most likely have to deal with by then?

The choice is yours. The opportunity cost of not doing it is yours also.