What if a ‘better’ Bitcoin is developed?

This is basically the main sales pitch for altcoins (all the 9,000+ other coins and tokens in the ‘crypto market’): ‘Bitcoin is old tech – look at our new tech!’ 😀

The fallacy in this concern is that the Bitcoin protocol is mistaken for a software product, instead of a software protocol that ultimately solved a century-old logical problem in 2009. A software product (like an app that can add some funny shapes to photos) could be replaced by a more fancy version of itself (like in our example, another app that can provide even more shapes). Bitcoin however is no software product, but a unique invention: it is a time-chain (references: [1], [2]), it is immutable, uncensorable, sound money, but even more importantly, it solved the Two General’s Problem and thus allowed triple-entry accounting.

As with any open-source project, it has always been possible to copy Bitcoin’s code and to try to imitate its network as well. Motivated by its success, indeed thousands of imitators have been created since it’s 2009 inception (as per 03/2021: 9,300 ‘alt-coins’!!), ranging from facsimiles such as Litecoin, pointless ‘forks’ like Bitcoin Cash, to overly complex systems like Ethereum or XRP. What unites all of them is that they were never able to even remotely reach Bitcoin’s adoption, reputation for security, decentralization of both it’s network and development, independence of centralized control, immaculate conception, or network effects. All of this again increased Bitcoin’s Lindy effect, which basically means that it’s life expectancy may go well beyond our current generation at this point in time.

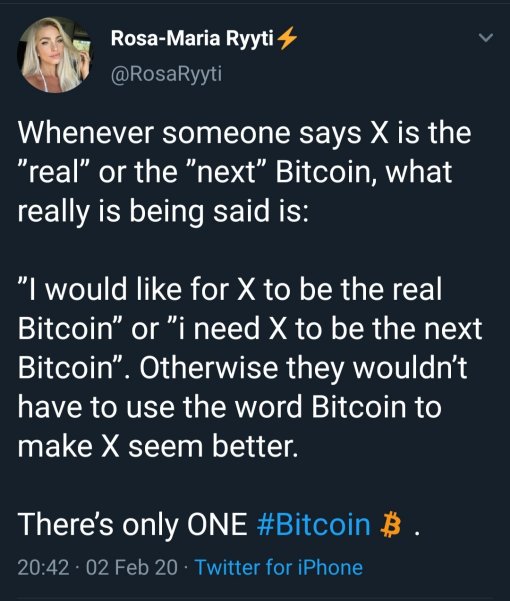

No doubt that altcoin creators & their marketers will continue to do everything they can think of to ‘workaround’ this head start of Bitcoin to help their own projects – often enough, this happens using ‘FUD‘ (spreading fear, uncertainty and doubt) about Bitcoin’s core qualities, technical aspects or future prospects. But their problem is hard to come by really: Bitcoin as a better form of money and accounting already exists! Bitcoin as the hardest monetary asset on this planet already exists! So they have to generate new ‘use cases’ (that no one ever asked for), to ‘improve’ particular aspects of Bitcoin’s protocol aspects (while downplaying their shortcomings and weaknesses), and often enough they also have to use little tricks to give the impression of relevance and network activity.

Millions of marketing capital flow into the generation of new altcoin projects (in other words: other attempts of creating new moneys) today – the goal is to give speculators the idea that they can ‘invest’ into ‘the next big thing’, something the world has still been waiting for, but that Bitcoin ‘unfortunately’ can’t give them. So these creations actually are software products, trying to capitalize on the innovation Bitcoin has brought and to grab a piece of Bitcoin’s cake of success.

However, because they are basically all trying to do that, in a very paradoxical way, altcoins themselves are the biggest competitors of altcoins. There are 100 competitors for every smart contract blockchain, 100 competitors for DLT-based hybrid blockchains projects, 100 for supply-chain management tokens etc., which leads to a dilution of all the money that flows into the altcoin space (while Bitcoin attracts a continuous stream of money by the people who actually understand its unique value proposal). Due to the lack of liquidity of altcoins, they are subject of ‘pumps and dumps’ and there is big competition among what are considered ‘cheap’ altcoins. Because most speculators are not even very skilled in mathematics, they think that if 1 token of a particular project is cheap, this automagically involves wide upside potential in terms of price growth. “1 Bitcoin once costed 10 cents, so logically, my coin which also only costs 10 cents / token has so much upside still!!” ![]() These people forget however, that these projects actually don’t compete with Bitcoin anymore – but only with the rest of the ‘crypto fiat’ market, which can produce and print tokens and new projects on demand, and where one hype is only replaced by the next ones, in the ever-lasting hunt of stupid money (people who lack of deeper insight into why Bitcoin has become as successful as it is, but just repeat the marketing phrases of randomly found altcoins) for ‘insane gains overnight’. It’s basically a redistribution scheme of stupid money owned by lazy people to smart money, with most of these Bitcoin holders in Bitcoin since many years, who are capitalizing on market cycles and the reiterated altcoin pumps & dumps to accumulate more of an immutable, limited Bitcoin supply.

These people forget however, that these projects actually don’t compete with Bitcoin anymore – but only with the rest of the ‘crypto fiat’ market, which can produce and print tokens and new projects on demand, and where one hype is only replaced by the next ones, in the ever-lasting hunt of stupid money (people who lack of deeper insight into why Bitcoin has become as successful as it is, but just repeat the marketing phrases of randomly found altcoins) for ‘insane gains overnight’. It’s basically a redistribution scheme of stupid money owned by lazy people to smart money, with most of these Bitcoin holders in Bitcoin since many years, who are capitalizing on market cycles and the reiterated altcoin pumps & dumps to accumulate more of an immutable, limited Bitcoin supply.

So there won’t be ‘another Bitcoin’ – because the problems Bitcoin solves (not ‘transferring money over the Internet‘ as many misunderstand, but: introducing a completely new monetary system featuring immutability, uncensorability, a hard monetary policy, after fair initial distribution without premining or centralized ownership, without central ‘leader figures’ etc.) have already been solved by it. There is simply no need, and most certainly also no second chance for another project to achieve all that again.

Any thoughts or comments? Please, add them below!

0 Comments