Bitcoin for Sinking Funds

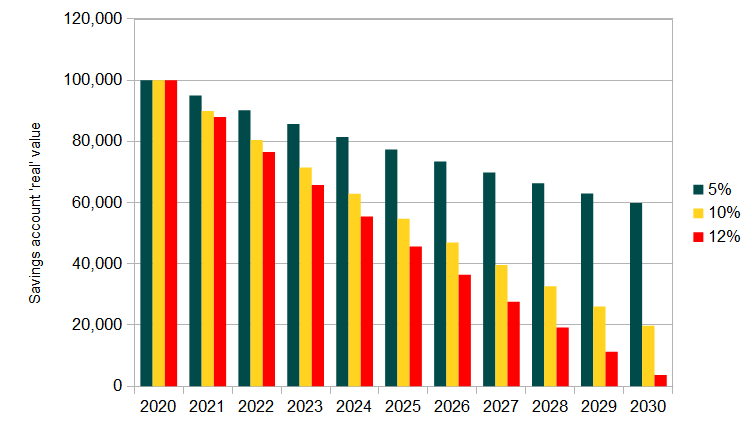

Condominium buildings suffer from very similar challenges as businesses in these times: their sinking funds (usually several $10,000 up to several millions of $) are turning into an ever-melting iceberg of capital. If we consider the increasing money supply as an indicator of real inflation instead of the Consumer Price Index (CPI), which is calculated from a questionable “basket” of goods and services bought by urban consumers (but not reflecting the actual money supply at all), any condominium management should be alarmed. Every year that the sinking fund remains untouched, about 5-15% less can be bought in the future:

Look at the image above to get an idea about the loss of buying value of 100,000 USD of sinking fund savings per year when assuming only a mere 5% of real inflation, up to a probably more likely 12% inflation.

This is a real challenge for any responsible building management: how to protect our building’s savings? Money that has been saved over years is at increasing risk of losing much of its value unless it’s spent as fast as possible (which would drain the savings also, and also incentivizes ‘bad spending’ – paying for services and goods that may not really be necessary, or have worse quality than such bought after enough consideration and doing extensive calculations). Indeed, pushing ‘spending’ just because money is losing its value is usually a bad idea. Much better is to look for ways to protect the value of the money the co-owner’s community has accumulated over the years.

Luckily, Bitcoin offers a way out. It has proven itself as hard money, appreciating in value by an average 200% per year since it first hit the markets. But in this article, we don’t want to advocate for any position in Bitcoin that could be considered as too risky by anyone, keeping in mind that Bitcoin, due to it’s ongoing price discovery phases, is still very volatile and has experienced price drops of up to 80% in the past (although observers of the markets expect these price swings to become less of an issue, as short-term speculators are successively replaced by long-term holders which are buying Bitcoin for exactly the same purpose a co-owners’ community would to: value preservation.

From today’s perspective, converting 5-30% of a sinking fund into Bitcoin could be considered as reasonable and responsible (to achieve the goal of value preservation), but also as conservative enough (exposition at this percentage would be limited, so even during a very bad ‘Bitcoin year’, most of the Fiat funds would be immediately available for emergency measures).

On top of that, Bitcoin offers fancy, but manageable means to control who has access to the funds – arguably even better ones than if the funds were saved in a bank! Why that?

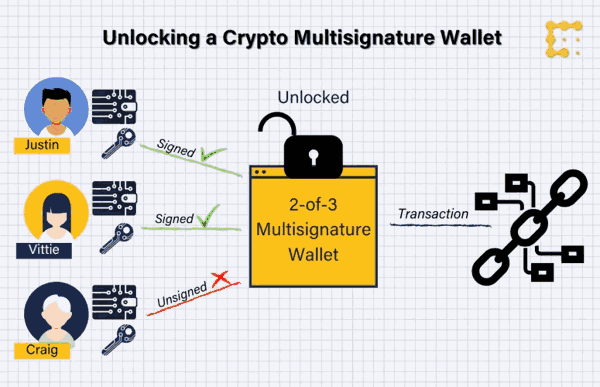

Well, Bitcoin has long supported a concept called ‘multi-signature security’ (or short: ‘multi-sig’), that allows to fine-tune access to the Bitcoin funds. To compare: often enough, a bank requires either just one or two signatories to show up at a bank to withdraw funds – or in some cases, all members of a management committee have to appear there. Obviously, the latter variant isn’t easy to organize, while only 1-2 signatories involve serious security problems if they get bad ideas – but it wouldn’t even have to be they themselves, they are simply 1-2 obvious security risks, be it for internal or external reasons. On top of that, many banks limit their damage insurance for savings accounts to a few 100k USD, if at all. So in case a condominium’s bank goes bust, so do by far most of their savings.

Bitcoin’s multi-sig system however offers to ‘share’ signatory powers between several entities: like 3 of 5, 2 of 3 or 5 of 7 for example. All it takes is for the management committee to buy Bitcoin and store them in a well-established and well-tested Bitcoin wallet like Electrum or Green Wallet. An important detail to consider with Bitcoin is that the wallets don’t hold the ‘physical’ Bitcoin, but only help to organize ‘state of the art’ key management. Imagine your ‘Bitcoin wallet keys’ as passwords that allow access to your Bitcoin on the global Bitcoin blockchain – your wallet will help you to create and to move your Bitcoin (like: from or to an ‘exchange’ that converts them from/to USD or EUR), but without the keys, the wallet is useless.

Even crypto exchanges, brokers or investment funds use multi-signature storage to secure their storage funds. They distribute admin keys for their funds in order to distribute the risk; if hackers want access to their reserves, they’re going to need several keys to do so. Similarly, multi-sig ensures no one person in the condominium building, including hostile employees or other attackers, are able to unilaterally withdraw funds from the account.

It is fair to say that this opens up a new and powerful chapter in condominium buildings’ financial management. Not only can they now protect themselves from increasing loss of savings due to increasing inflation (a problem that has been of growing relevance since the introduction of quantitative easing by the FED, the ECB and other central banks), but they can also improve their safety measures related to the large savings many condominium buildings have built over the years. Granted, there is a learning curve involved as with any new technology, but it is manageable and there are plenty of services available today that can help and support.

For the purpose of keeping it somewhat concise, let’s keep it with this for now – but we may add more in-depth instructions and thoughts later on. Don’t hesitate to add your comments below – particularly if you are interested in the topic and want us to extend this article.

0 Comments