rektless

Forum Replies Created

-

AuthorPosts

-

rektless

Keymaster“Liberals are going to love Bitcoin when they figure out what it will do for lower income families. But Democrats will hate it.

Conservatives will love Bitcoin when they figure out what it will do to the budget deficit. But Republicans are going to hate it.

(Parker Lewis)

If someone says that bitcoin was born from right wing or libertarian conspiracy theories, you know they’ve not done their homework. Bitcoin is cypherpunk software, and the golden thread uniting the cypherpunk movement is anti-authoritarianism, not opposition to the state.

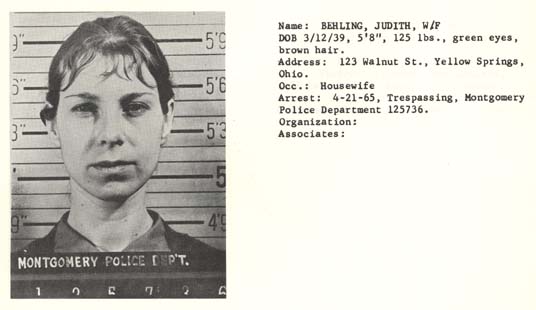

Cypherpunks opposed institutional overreach (corporate and state alike). They championed the use of technology to promote individual privacy and a culture of consent. Indeed, it was civil rights activist and hacker, Judith Milhon (a.k.a. “St. Jude”), who first coined the term “cypherpunk”.

The history of the cypherpunk movement is pretty interesting in itself – here, for example, is a concise and well-sourced intellectual history of the cypherpunk movement showing, among other things, its connection to free speech movements, its capacious ideological umbrella, and the anti-authoritarianism that united them all.

Where, then, did this ‘Bitcoin is right-wing’ canard come from? I have two hypotheses: first, a book by David Golumbia, riddled with economic and historical errors and published in 2016, found an audience mostly due to its timely appearance. William J. Luther reviewed the book here (PDF download available).

Second, libertarians on the right were sometimes quicker to embrace bitcoin than civil rights activists on the left or elsewhere. This is changing, even within the last year or two. But observers are, understandably, slow on the uptake.

Digital authoritarianism – the use of computers to surveil and control – is on the rise. You needn’t be on the right or left to see it. Cypherpunks gave us a hopeful tool to fight back. Cypherpunks write code. Bitcoin isn’t founded on conspiracy theories. It’s founded on hope.

Further reads and information:

- “Bitcoin helps low-income Americans cope with inflation” (USA Today)

- Ludwig von Mises: “Human Action”

- “The Rise of the Cypherpunks” – The motivations behind the movement that spawned bitcoin and share its vision for the future. By Jameson Lopp

- The Cypherpunk Manifesto.

This page in its current state is originating in a Twitter thread by Andrew M. Bailey, one of the researchers at Resistance Money. Check out their website for more illuminating articles on Bitcoin’s potentials. Title image by L0la L33tz.

rektless

Keymasterrektless

KeymasterWe’ve compiled a list of recommended Bitcoin exchanges for you, along with some ratings to help you make a good decision.

We have added a few ratings that indicates how dedicated the listed exchanges are in terms of Bitcoin support (adoption of the latest Bitcoin technology, liquidity, not trying to lure newcomers into altcoin gambling etc.), and we give you ‘pure’ links to the exchanges as well as ones with reference codes (if available). The ones with refcodes will usually give you initial discounts for your first Bitcoin purchases, and by using them, you also support this website. But we’re also fine if you decide to use the pure links.

Exchange BTC liquidity BTC support Altcoin maze Direct URL notes Swan Bitcoin not relevant 10/10 10/10 Enter # Relai not relevant 10/10 10/10 Enter # Bisq DEX 2/10 8/10 10/10 Enter # HodlHodl DEX 3/10 8/10 10/10 Enter # Kraken 8/10 8/10 5/10 Enter # Bitfinex 8/10 10/10 5/10 Enter # Binance 9/10 5/10 1/10 Enter # Coinbase 7/10 3/10 1/10 Enter # Huobi 9/10 7/10 6/10 Enter # Kucoin 8/10 7/10 5/10 Enter # OKEx 8/10 9/10 6/10 Enter # Details on the listed exchange services: SwanBitcoin is dedicated to support Bitcoiners in many ways, including education and with a particular focus on supporting the DCA (Dollar-cost-averaging) saving’s strategy that has worked out very well for Bitcoiners in the past. On top of simply buying Bitcoin at ‘spot’ (a certain amount for a certain price), you can automatically buy for a fixed amount and have your Bitcoin transferred directly into your cold wallet. Top-notch exchange for Bitcoiners, unfortunately only for US-based ones so far. Requires KYC.

Relai is quite similar to SwanBitcoin in a way, but only available as an app, and focused on European customers. They also offer DCA-buys, and what’s amazing is that no KYC is required! Direct transfer to cold wallet also supported. Using refcode REL10041 during your order, you pay 0.5% less in fees.

Bisq is a decentralized exchange (DEX) completely focused on Bitcoin (and Monero as the only altcoin). Liquidity is not great, but good deals especially for smaller slices of BTC can be made if you are a bit patient. Very safe and battle-tested, but for more advanced users, as you have to make a refundable safety deposit (in Bitcoin) for your deals first, therefore, KYC is not necessary. Safer than face to face deals.

HodlHodl is another decentralized exchange that requires no KYC. Like Bisq, the DEX doesn’t hold funds, so your coins are directly transferred from/to your wallet. Has usually slightly better liquidity than Bisq and lower fees, and on top of that, doesn’t require a security deposit.

Kraken certainly belongs to the most serious and customer-oriented exchanges, has a good history of protecting them even after attacks, and supports the Bitcoin environment. No Lightning Network support still though. Good for European users is their support of SEPA transfers.

Bitfinex is, along with Kraken, known for a very supportive stance for Bitcoin, and even offers Lightning Network transfers to fund or withdraw Bitcoins to/from the exchange which makes these transfers very cheap and superfast. Good liquidity for Bitcoin and nice trading interface.

Binance has a nice user interface and has great marketing, so many users are attracted to it. As an exchange for Bitcoiners, it’s mainly the good liquidity that makes it worthwhile. In terms of dedication to support the #1 coin in the market, Binance has shown lack of adoption of the latest technologies like the Lightning Network etc., and is known for trying to lure users into buying altcoins to make them more fees. It has to be noted though that Binance is also mining Bitcoin since 2020, and users can buy hashing power.

Coinbase may well be called one of the most Bitcoin-hostile corporations out there. They have supported the ‘Segwit2x’ attack against Bitcoin in 2017, actively cooperate with Chainalysis, actively support diluting the market with useless projects/potential scams, they provide governments with surveillance tools (‘Coinbase Analytics’), have been found guilty of wash-trading / market manipulation, have a bad image among traders for because their engines often ‘unfortunately’ going down whenever Bitcoin has massive price spikes etc. On the other hand, they are also the 1st address for major corporations for custody and large-scale purchases of Bitcoin. For retail investors however, more Bitcoin-friendly and customer-oriented exchanges may be the better choice.

Huobi is one of the largest Chinese exchanges and provides great Bitcoin liquidity.

KuCoin is one of the youngest exchanges in this list, but has shown sustainable and impressive growth and become a popular exchange. It has good Bitcoin liquidity, but also a maze of altcoins in which newly arriving customers can easily get trapped.

OKEx is the largest Chinese exchange and just as Huobi, has good Bitcoin liquidity. OKEx is also very actively supporting Bitcoin and its latest technology, just recently they added support for Lightning Network to transfer Bitcoin from/to the exchange, which makes this process superfast and cheap. Recommended.

Whichever exchange you are using:

- “not your keys, not your Bitcoin”: don’t leave any money (be it Bitcoin, USDT or whatever) longer in an exchange ‘wallet’ (which is basically just an IOU similar to a banking account, not a real wallet) than absolutely necessary.

- Whenever time isn’t of the essence, prefer decentralized exchanges over centralized ones, and KYC-less exchanges over such that require KYC. Centralized choke points and entities sniffing on your private, financial information are to be avoided. This may even become crucial at some point, especially in countries turning authoritarian or getting closer to bankruptcy (example). Bitcoin was created to give you full ownership over your property – honor that, and don’t make your coins an easy target when there are ways to maintain both: your financial privacy and maximum security!

rektless

KeymasterBitcoin appears superficially simple upon first glance, however, truly understanding both the system and its value proposal is a daunting task. “Intellectual traps” exist along the way, tricking observers into making hasty assumptions. The pursuit of understanding Bitcoin can be compared to a mountain climber continually reaching “false peaks” that momentarily fool him into thinking he’s reached the actual summit. But as soon as you, the mountain climber, think you have Bitcoin figured out, you discover how little you actually know (false peak)…

Many also describe their journey of discovering Bitcoin as ‘having fallen into a rabbit-hole’: you do a few steps, might say to yourself “well that was not so hard!”, but if you move on, out of a sudden you might feel that you actually understood little to nothing and fall into an even deeper hole, and again, after spending more time for intellectually challenging (re)search, you start to see some light at the end of the section … just to find another dark corridor awaiting you.Competing narratives make a genuine discovery process even more challenging… too many cliché-ridden premature ‘exits’ are awaiting the explorer: ‘Magic Internet money’, ‘speculative mania’, ‘fintech revolution’, ‘Bitcoin boils the oceans‘, ‘rat poison squared’, ‘libertarian idealism’, ‘Ponzi’, ‘digital gold’, ‘apex predator of monetary media’, ‘Gordian knot of interlocking incentives’, etc.

True understanding is a moving target unlikely to ever be hit… and everyone claiming to ‘have understood Bitcoin’ is actually revealing that he hasn’t (usually without even realizing it).

Most Bitcoiners looking back at their journey say that it took them at least 2-3 weeks (or 40-60 hours) of intense reading or watching explanatory videos until they had sorts of an ‘enlightenment’ and realized Bitcoin’s full potential. We have collected some of the best resources that should help you to get up to speed in ‘no time’ (well, the time estimated above… sorry!) as well. Just don’t give up. There’s lots of things to learn.

Articles

- The Bullish Case for Bitcoin, by Vijay Bojapati (article; reading time 60 min; Audible version avail.)

- 21 Lessons, by DerGigi (article in 21 chapters, describes the journey of a ‘Bitcoiner’ along with lessons to understand why this particular software protocol is that revolutionary; Audible version on website)

Books

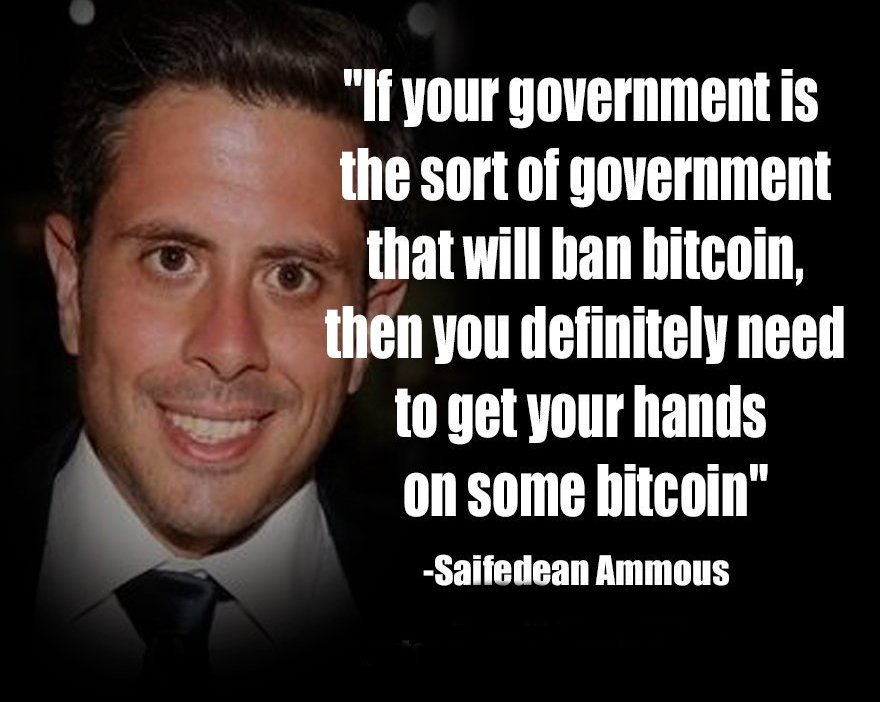

- The Bitcoin Standard, by Saifedean Ammous

- The Price of Tomorrow, by Jeff Booth

- The Sovereign Individual, by Davidson / Rees-Mogg

- Human Action, by Ludwig von Mises

Videos

- Introduction to Bitcoin: by Andreas Antonopoulos (playlist with several intro videos)

- Banking on Bitcoin: Bitcoin history and basic concepts (duration: 1:20 hrs)

- Bitcoin Macro Strategy: Michael Saylor and Ross Stevens on the potential of Bitcoin in times of rising inflation, melting corporate (and private) treasuries/savings and global instability (duration: 45 min)

Websites

- Lopp.net – a great starting resource for in-depth research on all topics related to Bitcoin

- Grokking Bitcoin – one of the best technical books on Bitcoin, fully available online

- Crash Course – Bitcoin beyond just the tech: societal and political visions

Podcasts / Audio

- BitcoinAudible – the best articles on Bitcoin & related topics, conveniently read for you to be listened to in your car, during sport, or on the beach 🙂

- Stephan Livera podcast – among the 100+ (!!) Bitcoin-only (!) podcasts out there, this one covers a broad range from technical to economical topics directly related to Bitcoin, very educational content here.

- Swan Signal – a podcast hosted by Swan Bitcoin exchange, covering a broad range of technical, economic and philosophical topics related to Bitcoin.

- What Bitcoin Did – hosted by Peter McCormack, who amazingly turned Bitcoin ‘maximalist’ after educating himself through his broad selection of guests, covers beginner’s to controversial topics

- Tales from the Crypt – hosted by Marty Bent who is also authoring a popular newsletter, is focused on latest tech and economic developments, often from an angle you rarely hear about in traditional media.

Please let us know if something’s missing here (spam, unrelated or irrelevant link posts will be removed and might induce bad karma for you).

rektless

Keymaster“Salad consumes more energy than Bitcoin. Just imagine what we could do with all that sunshine!”

The “Bitcoin wastes Energy!” prejudice is one of the most often heard ones, and at the same time one of the most frowned upon ones for Bitcoiners, as it has been refuted excessively in countless articles, podcasts and videos – so usually, a person making this claim either doesn’t sufficiently understand Bitcoin’s value proposal, or he/she wants to attack the project for selfish reasons.

On this page, we will look at Bitcoin from several angles and show that in fact, Bitcoin does not ‘waste’ energy – rather just the opposite! -, and on top of that, Bitcoin provides a lifeboat for anyone exposed to our factually wasteful, current Fiat-based financial system – maybe even the world as a whole.Bitcoin – by the very definition of this word – isn’t ‘wasteful’.

What is ‘waste’? In the Oxford Dictionary, ‘wasteful‘ is defined as ‘using or expending something of value carelessly, extravagantly, or not to purpose.‘ By this very definition (and isn’t the correct use of our language crucial for meaningful communication?), Bitcoin can’t be wasteful, as the electricity for mining (‘finding’ new blocks for the Bitcoin ledger in which transactions are confirmed and stored) is only used for exactly this purpose.

Bitcoin miners do not consume electricity carelessly, extravagantly and certainly not to no purpose. Waste would mean a) that this energy would be a good that would be used otherwise if it weren’t for mining, and b) that consumers of electricity should not be allowed to decide by themselves what they wish to use the electricity (a service, not a good!) for that they have purchased.

Where would this stop? Would gaming consoles be next, then microwave ovens, and finally, these horribly wasteful A/C’s during summer and heating during winter? What would the ‘saved’ energy be used for instead?

Also, explain to the half of the world living under authoritarian governments that ~1/3 of mining is still non-renewable and thus, we, the righteous people, want it stopped!Bitcoin gives not only ourselves, but especially also these oppressed, unbanked or otherwise disadvantaged people something they never had before: a choice.

The Fiat system actually is wasteful.

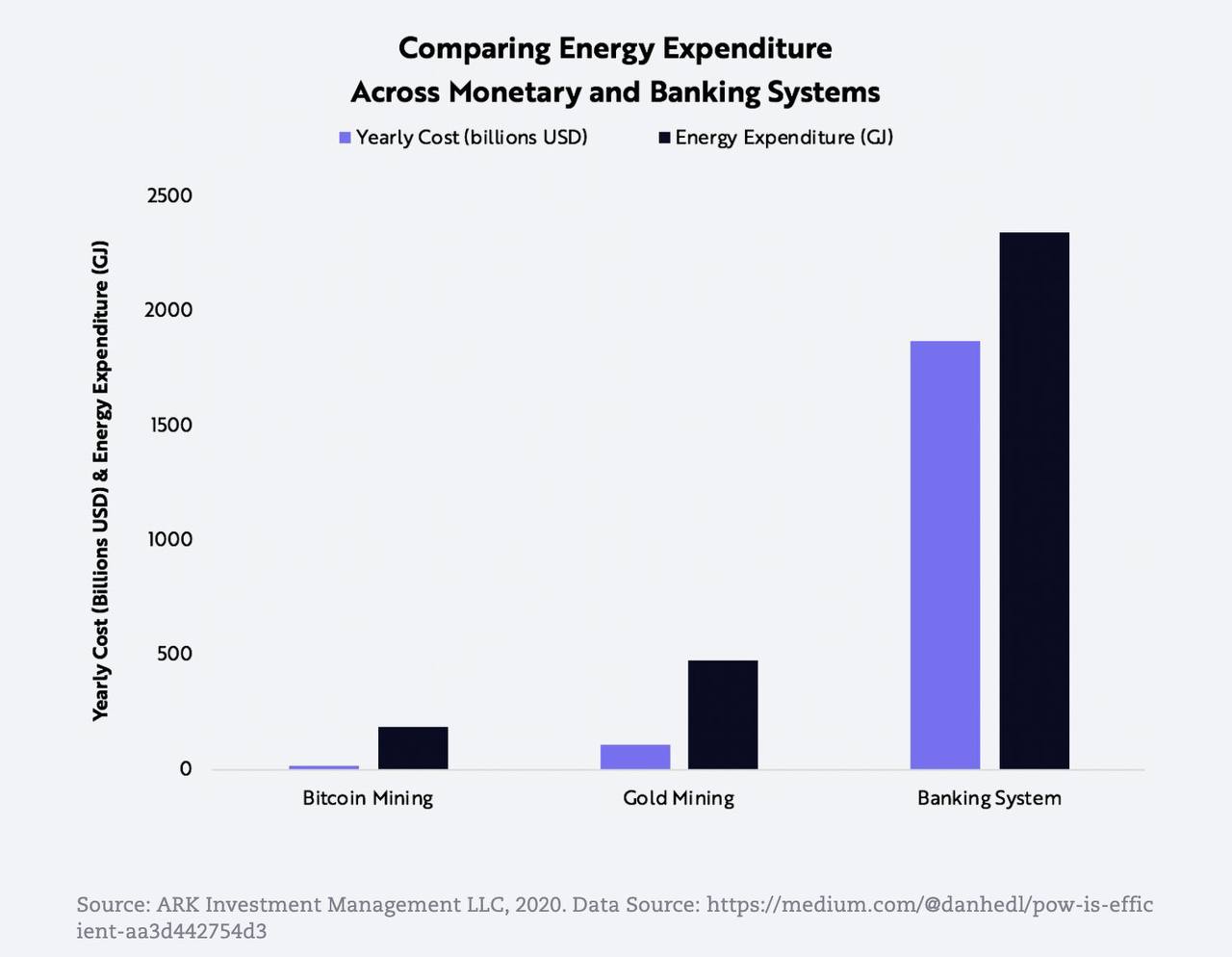

Banking system 140 TWh per year Bitcoin 32 TWh per year Bitcoin energy use vs banking system (as per 2018, Source article). When comparing these values, don’t forget to consider that Bitcoin doesn’t require intermediaries – in other words, 2 people can transact money directly, without requiring anyone in between, thus making most of the services that banks are providing dispensable. Worse environmental footprint. The Fiat money system, as a matter of fact, actually wastes electricity and has a massive carbon footprint compared to Bitcoin. Just comparing the electricity cost of a single Visa card transaction is completely ignoring the environmental impact of the massive infrastructure that sustains Fiat money and the enormous collateral damage that Fiat brings.

Distorts and corrupts economic activity. It is provably prone to cronyism, and distorting price signals lead to huge frictions and inequality. Economic activity can’t be properly coordinated by a manipulated medium of exchange and store of value, but is instead confounded by the decisions of a few who have been given the power to create money out of thin air, and then to distribute it to the entities close to them. As the Cantillon Effect describes: contrary to popular belief, this money doesn’t somehow ‘trickle down’ to the less fortunate, but remains stuck at the top of the distribution pyramid for most parts. As a result, much of the economic resources of a society is absorbed and wasted by debt that is put on the current and future generations…

Fiat-based economies go through boom and bust cycles – but rarely we see someone even mentioning the real price of Fiat’s recession phases: a high human toll and trillions of wealth destruction – wealth that took an enormous amount of resources (including carbon) to create. The carbon cost equivalence of these recessions is astronomical. If environmentalists took that into account instead of keeping it with superficial comparisons of ‘transactions’, the logical solution should be to base our economies on a non-inflationary asset with sound monetary principles, which we already have in Bitcoin.

Inflation produces garbage. On top of all that, soft money that is subject to devaluation incentivizes governments, corporations and individuals to consume rather than to save. Carefully pondering over necessary purchases and investments is considered a bad thing in Fiat-based economies, as it ‘doesn’t help the economy’ as we are told. But what really does happen is: it results in a constantly ‘melting’ stash of value. Money you don’t spend today will be worth less next week, so rather buy some cheap plastic product today, you can still replace it tomorrow when necessary! This dynamic, triggered by an ever-growing supply of money, results in a historically unique pile of garbage that our world is producing – a direct result of our fiat-dominated world economy, with citizens who are not only incentivized but even motivated to spend and to produce short-lived stuff rather than to save or to produce stuff that keeps its value for a long amount of time.

This is why the world may very well need a ‘Bitcoin standard‘ to turn things around … it won’t happen under a ‘Fiat standard’! We and the environment we live in will not be saved by spending even more taxes for a so-called ‘Green Deal’ – what we need is an ‘Orange Deal’.

Care for a few facts and numbers?

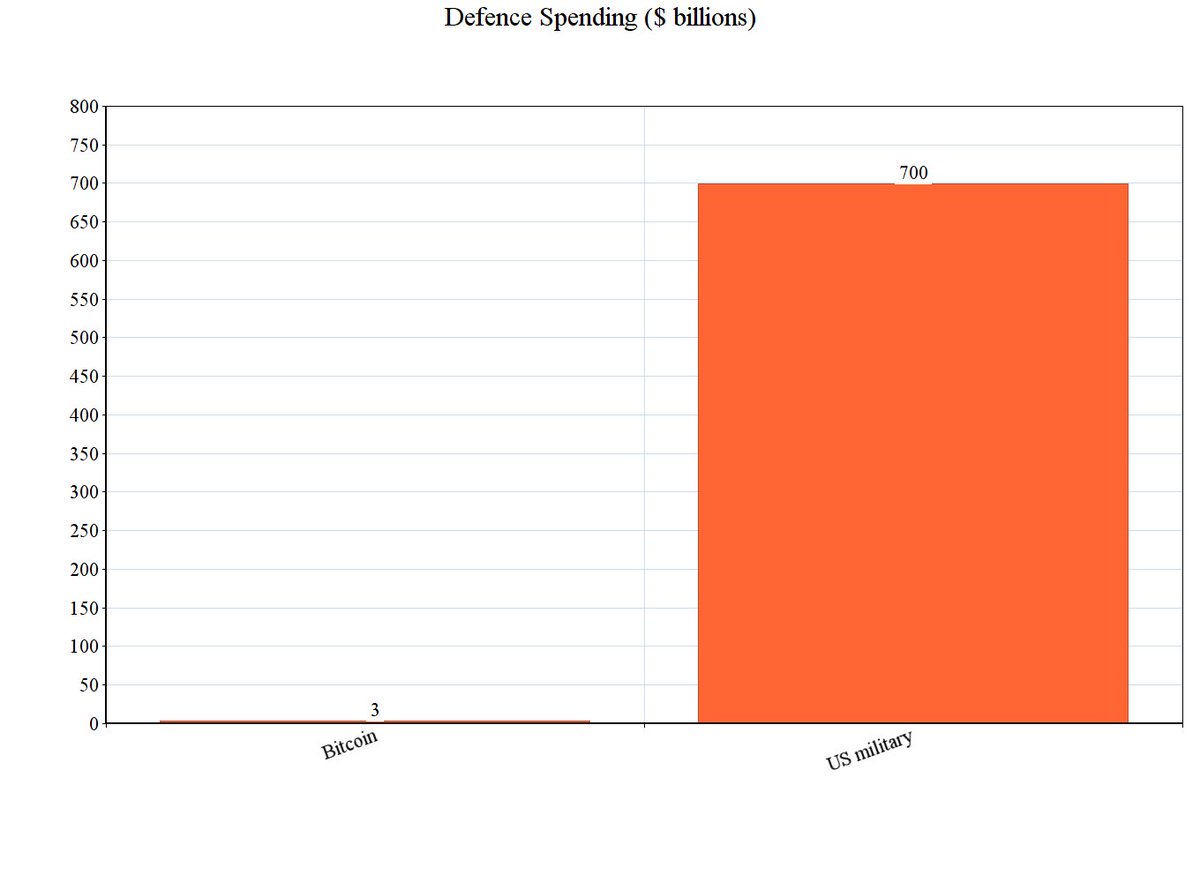

“Bitcoin mining, in its 10 years of existence, consumed as much as US cars alone do in 3 days.

1790635332537685941996748800 hashes computed by S9 miners ~= 1.75 e17 joules ~= 4.2M tons of oil. US cars consume ~1.3M tons of oil per day.”Bitcoin seeks out the inefficiency of the energy market at the edges: wasted hydro, flare, gas, solar, wind. It is not far-fetched to expect Bitcoin to make the whole, worldwide energy market to become more efficient. We can see it as a perpetual bounty program for innovation in energy production. Energy itself is not scarce – it’s all around us!

To get a better understanding of our reasoning in this article, it helps to understand a few basic concepts:

First off, we have to understand the difference between electricity production and electricity consumption. Power plants of any kind – be it a coal plant in China or a solar cell on your rooftop – convert a natural resource into electricity. This is called electricity production. Bitcoin mining converts electricity into hashes. This is called electricity consumption. Consumption itself does not create emissions – it is basically using a service that has been produced in and for the free market of goods and services. Who should be allowed to approve which uses of a purchased service are, and which are not acceptable? Where does it start … and where would it end? Ultimately, the most ‘ecological’ solution would for us to return to live in caves – without using fire of course, to avoid air pollution.

Another important point to consider: if there is more demand for energy, the incentives to develop power plants for renewables are increasing. Everyone (falsely, as this article hopefully clearly illustrates) ranting about Bitcoin’s ‘additional’ usage of energy seems to ignore this very simple fact: Bitcoin creates positive pressure for the development of energy efficiency. You can conclude from each of the sections in this article that in many ways, Bitcoin miners are actually the first entities optimizing their very own activities in exactly this manner: they try to optimize their mining farm locations, operation times, electricity sources etc. to utilize renewables. As one of the consequences, the percentage of renewable energy used for Bitcoin mining is increasing every year.

Much of the ‘Bitcoin wastes energy’ line of argumentation consists of false analogies (‘comparing ‘apples and oranges’). The problem with this type of discourse is: it hinders meaningful discussion, and only shows that the skeptic either doesn’t fully comprehend what the Bitcoin project actually is about, or that his/her actual objective is to protect the existing concepts of how things work.

Image: “People, should we ban the banking system or gold mining?”

Okay, enough with the pointless ‘apples vs. oranges’ offsetting for today – but wait, allow me just for one more: – Bitcoin has a carbon footprint of ~ 22mio tonnes. CF of 1 child = 60 tonnes, 1 car = 2.4 tonnes (equiv to 25 children) … so Bitcoin has the same CF of 360,000 children or 14,000 cars. Could we start by reducing the world population growth by 0.00000005% for one day? 😉

– oh, and just a short, final question: how much energy do YOU consume per day? Take a few minutes to calculate it honestly, including all the services and resources that went into it. And then justify every aspect of your energy usage. Thank you for your cooperation.We can imagine Bitcoin as a race to the cheapest energy source.

Bitcoin miners are incentivized to look for cheap energy sources in order to maximize their gains on finding new blocks. The cheapest energy sources are usually the ones where there’s little competition from civilization. As a basic rule: the farther away from cities and the less effort to generate it on a continuous basis, the better. Until about 2011, it was still somewhat feasible to mine on personal computers, until 2016, it was with specialized mining devices (ASIC’s), but these days, mining has become a highly specialized industry which requires entrepreneurial, technical and economical skills and other knowledge in order to be sustainably successful. Because of that, new mining farms are often created close to natural energy sources, where with a minimum of construction efforts, preconfigured mining units and reasonable startup investments, mining can be done as long as possible and without requiring additional resources or capital injections. Renewable energy sources are perfect for this kind of enterprises: once set up and running, they can run virtually forever and require only a minimum of manpower, mechanical intervention and additional resources.

The optimal scenario for Bitcoin mining is to use spare energy – it’s always the cheapest one (sometimes even free), regardless of the source. Our power grids and the power stations that feed them are built with a capacity to cover everyone during the hottest summer days with all A/C’s turned on (or the coldest winter days with all of our heaters running)! This results in an enormous over-supply during 90% of an average year – the generated power is produced, but not used – ‘wasted’. This is ‘waste of energy’ (although we had little other choice so far)!

Now, however, we have a choice. Unlike power plants (for which this is a process that can take days up to several weeks), Bitcoin mining can be switched on and off by the flip of a button. Miners will enjoy the highest profits when they only switch on their farms during times of low energy consumption – during nights, or at average temperatures. Otherwise, the – continuously, and regardless of demand – generated electric power would just remain unused! The respective electricity would basically just ‘disappear’ without having helped anyone! On the other hand, should there ever be energy shortage, the electricity prices will go up – some miners will stop mining, which will make the consumption drop as well.

Wait, what about the heat?

Miners will always try to make their mining activity as efficient as possible. They are not happy if the electricity they have to purchase is turned into heat – they want it to be turned into Bitcoin! But that their mining rigs are turning part of this energy into heat and need to disperse it is part of a mining operation’s business that they accept. If a new, more efficient type of integrated circuit that mined without producing a lot of heat came on to the market, rational miners would switch to it for the power savings and increased profits, it is for this very reason why we find an increasing number of mining operations moving to cold countries or to locations where there is constant wind flow: in order to maximize natural cooling and minimize loss of energy.

The market encourages participants to strive for efficiency in both, energy production and efficiency of usage.

Why not simply replace Proof of Work?

Some Bitcoin skeptics who consider themselves open-minded, will even admit the necessity or at least utility of Bitcoin, but then end up asking: ‘why not at least make it more eco-friendly, and switch from Proof of Work (PoW) to another consensus model?’ This implies that PoW has no particular purpose that wouldn’t be relatively trivial to replace by some other ‘technique’ which would achieve identical goals, but requires ‘less energy’.

The fallacy begins with ignoring the aspect of unforgeable costliness (Nick Szabo): if an intended store of value is easy to create or reproduce, then more production will inevitably happen at some point, resulting in this store of value losing value over space and time. This is one of the major problems with most altcoins by the way: if they were printed out of thin air (a.k.a. ‘premined’), it is relatively trivial to print more of them given enough demand. In fact, we have witnessed this in plenty of projects that were introduced as ‘alternatives’ to Bitcoin: altcoins have been ‘frozen’, ‘minted by staking’, ‘put into escrow’, ‘burned’, inflation was introduced and/or removed etc. The goal was usually to re-adjust the number of tokens in circulation based on ‘needs’ that arose at some point, but at all times it basically just took a change in code or convincing parties who held power in the ecosystem in order for a casual number of tokens to be newly generated or destroyed.

With a token that can only be created if considerable amounts of time + energy are invested, there are limitations set by the laws of physics: both can’t be forged, and require ‘skin in the game’. Bitcoin sets the bar even higher, by adjusting the difficulty at which new blocks can be ‘mined’: so as we’ve learned by mainstream media, it now takes the ‘energy production of whole countries’ and requires specialized hardware to find (‘generate’) new Bitcoins. This massively improves Bitcoin’s security, but also hardens its monetary rules. For Bitcoin as a reliable form of hard money with a credible monetary policy and distribution rate it is actually an advantage, if not to say a super-power to require a ‘physical’ investment of energy + time to both generate and secure its monetary units and (via Bitcoin’s network of 10,000+ nodes verifying the correctness of the mined blocks and the transactions they contain) to prevent tricking or ‘bypassing’ its monetary rules – which has been the biggest problem of any form of money that humans ever used! Bitcoin is basically a world-wide, 24/7/365 honeypot for attacks on both, it’s security and monetary policy – but it has proven utmost resilience against all of these efforts so far.

We will add a separate article covering this and other attack vectors at a later point. The article you’re reading here is just an answer to the ‘energy waste’ attack vector, which is a social attack in order to create pressure on the Bitcoin community to switch to a weaker security model. But as you may start to understand by now, this won’t happen anytime soon! 😉

Energy use is an indicator of societal progress.

Whatever mankind values, he produces more efficiently:

– gold’s monetization led to more gold production

– Bitcoin will lead to more energy productionIsn’t that a bad thing?, you may ask. Not at all. Look at the history of mankind: whenever humans found a way to produce more energy, it led to new levels of progress, not only in a broad technological sense, but also with impacts on society and general wellbeing. Bitcoin, as already described above, incentivizes improving efficiency in energy production, which itself improves efficiency, wealth creation and living standards.

Almost infinite amounts of energy are available – increasing the efficiency in which we consume and store it moves us closer to a Type 1 civilization on the Kardashev scale.

Because of the above, Bitcoin is actually the long-term solution to climate change. For three reasons:

a) Bitcoin, unlike Fiat money, honors the principle that the primary reason any market good has value is the energy input of production. It can not be ‘printed’ out of thin air.

b) As a consequence, Bitcoin mining incentivizes utilizing & building renewable and otherwise unusable or unused energy sources.

c) As a consequence, Bitcoin directly and indirectly incentivizes long-term planning and saving.

The third consequence has massive potential in particular. Bitcoin by its very nature is hard, sound money – after the ‘halving’ of 2018 it’s ‘Stock to Flow‘ value has become similar to gold’s. So basically everyone who is holding (instead of spending) Bitcoin as money is better off in the long run. This incentivizes carefully evaluating whether anything one is spending money (Bitcoin) on is worth the expense or not. In other words, it triggers a domino effect of changes of thinking in times of historically unmatched amounts of plastic garbage, destruction of precious rainforests and turbo ‘production’ of goods that have no lasting value.

Ironically, it looks more and more as if we can’t save the world without Bitcoin. Efficient action and global coordination require a sound monetary base.

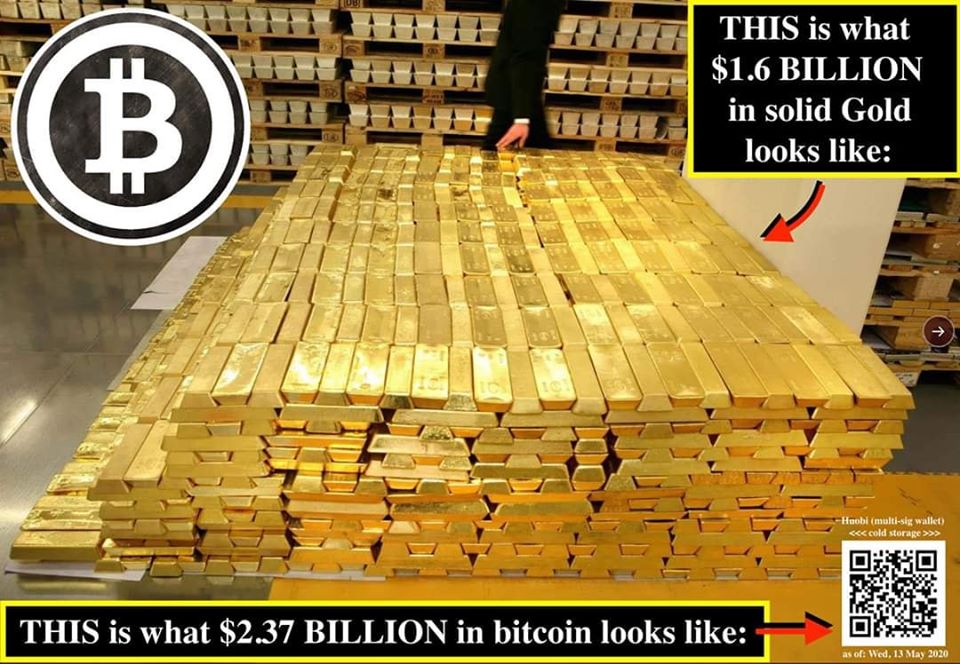

How about using gold instead of Bitcoin?

Money is a social technology used to solve a problem which has persisted for all of humanity’s existence: how to move and protect economic value throughout space and time. Since thousands of years, gold has fulfilled this role, it was the physical standard of money. Why is Bitcoin often called the digital standard of money, or ‘gold 2.0‘?

Property Bitcoin Gold Scarce (limited supply)

only in theory Durable

..

..Portable

costly Verifiable

costly Divisible

not easy Fungible

Recognizeable  ..

..limited Storage cost

costly Microtransactions

Easy value transfer

Censorship resistance

Auditable supply

Programmable

We see that Bitcoin is indeed a ‘better version of’ gold – gold 2.0. The physicality of gold can be both, an advantage or a severe disadvantage, as the comparison shows.

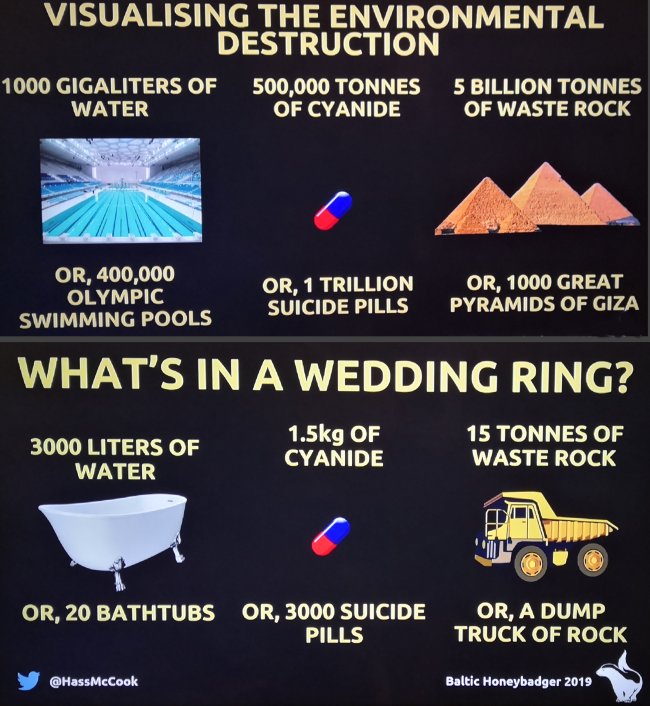

But how does gold hold up against Bitcoin – the digital standard for money – in terms of its environmental effects and sustainability of mining?

Bitcoin Gold Barrels of oil consumed for mining 6.6 million barrels 123.2 million barrels Energy consumption (GJ) 183,000,000 500,000,000 (mining & recycling) USD cost per GJ $25 $1,821 Total annual energy consumption in a million barrels of oil equivalent. Source: Marc Bevand Blog, Newmont & 2017 GFMS World Gold Survey

If we had a way of getting everything that gold gives us – but that a) only requires electricity, b) helps to even reduce wasted and lost energy (see the details outlined in the other sections) and c) can prevent the catastrophic impact on the environment that gold mining has – why aren’t we stopping gold mining already? The world’s existing gold supply would be sufficient to cover all uses for jewelry, dentistry and electronics for many decades, if not centuries.

Gold mining is one of the most destructive industries in the world. It can displace communities, contaminate drinking water, hurt workers, and destroy pristine environments. It pollutes water and land with mercury and cyanide, endangering the health of people and ecosystems.

Bitcoin doesn’t require all that. It seeks the most efficient, usually renewable forms of energy or energy that isn’t used for anything else. Bitcoin is the better gold.

Energy corporations mining Bitcoin – isn’t that bad?

Okay, so you’ve read several sections on why the energy-related concerns about Bitcoin might be strongly exaggerated, or even completely miss the point – but one question remains: why are we currently seeing an increasing number of corporations, namely energy producers, getting into Bitcoin mining?

The CEO of Norway’s Aker Corporation (one of Europe’s largest energy producers), Kjell Inge Røkke, probably described it best in their 2021 shareholder’s newsletter, explaining why he founded SeeTee, a new company that will invest in the Bitcoin ecosystem but also look for reciprocal effects with Aker’s very own operations:

“Mining operations (…) transfer stranded or intermittent electricity without stable demand locally —wind, solar, hydropower— to economic assets that can be used anywhere. Bitcoin is, in our eyes, a load-balancing economic battery, and batteries are essential to the energy transition required to reach the targets of the Paris Agreement.”

Bitcoin creates a global liquid market in electricity. Cheap energy anywhere on the planet can be monetized and act as a global subsidy for energy production, which itself invites for massive investments in off-grid energy sources. It will pay to invest in utilizing stranded or unused energy sources – which by itself will gradually kill energy subsidies (particularly for such using ‘dirty’ forms of energy generation!), which is great for efficiency and sustainability.

Notable and very interesting projects apart from the one of Aker are Great American Mining (specialized in utilizing stranded or flared gas to mine Bitcoin, thus reducing carbon emissions) or UpstreamData, specialized in utilizing methane gas (their portable Bitcoin mining datacenters reduce carbon emissions by over 0.3 metric tonnes per year for every $1 in capital deployed!).

And then there is an ever-growing number of projects focusing on green mining, like Argo’s TerraPool, the first Bitcoin mining pool exclusively mining with 100% clean energy, and even the first progressive and modern cities with politicians realizing the enormous potential of Bitcoin and trying to create a favorable but also guided environment for mining, like Kentucky‘s bill of March 2021, HydroCryp‘s massive projects for Paraguay or the “Golden Goose Project” also in Paraguay, which will soon utilize the massive excess energy produced at the Itaipu hydropower dam for Bitcoin mining, or Neptune‘s recently announced ambitioned green energy mining project in Alberta, Canada (planned expansion into other countries).

Great times ahead. And open-minded forward-thinkers are rewarded – as usual.

Mining secondary use

Over the years, people have come up with very creative ideas about how to ‘utilize’ mining beyond just discovering new bitcoins – in other words, to achieve positive side effects when already converting energy into electricity.

- BitBoiler – a DIY water & room heater for homes, factories, greenhouses, …

- BitcoinHotTub – a.k.a. SPA-256, using mining exhaust heat to heat water

[we know that there are several other projects and creative ideas on how to put mining to ‘secondary use’ – please let us know through the contact form or the comment section if anything is missing here!]

Further reads

- “Bitcoin is Key to an Abundant, Clean Energy Future” by Bitcoin Clean Energy Initiative (BCEI), I recommend listening to the audible version which also includes a commentary explaining a few of the concepts and technical details

- “How Much Energy Does Bitcoin Actually Use?” by Nic Carter, and

- “The Last Word on Bitcoin’s Energy Consumption” (video)

- “No, Bitcoin won’t boil the Oceans” (by Elaine Ou, Bloomberg article)

- “Does Bitcoin Use “Too Much” Energy?” by Allan Stevo, Mises Institute

We can conclude:

“Bitcoin is the most energy-efficient savings technology ever discovered.“

(Pierre Rochard)Please let us know in the comment section or through the comment form if you have additional ideas, found disputable claims or data, or simply want to share your thoughts about this topic!

rektless

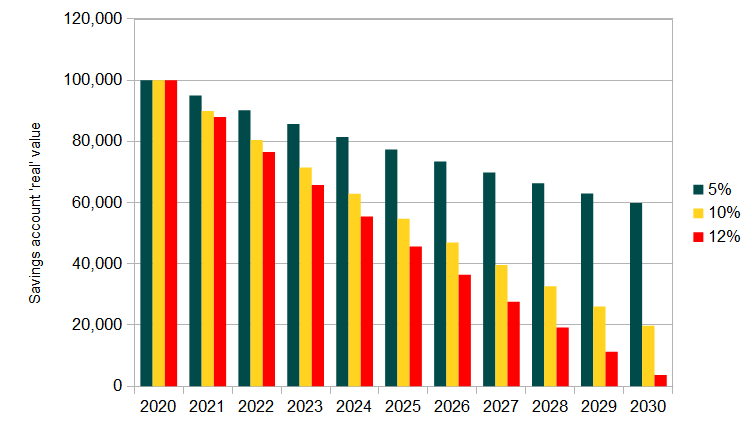

KeymasterCondominium buildings suffer from very similar challenges as businesses in these times: their sinking funds (usually several $10,000 up to several millions of $) are turning into an ever-melting iceberg of capital. If we consider the increasing money supply as an indicator of real inflation instead of the Consumer Price Index (CPI), which is calculated from a questionable “basket” of goods and services bought by urban consumers (but not reflecting the actual money supply at all), any condominium management should be alarmed. Every year that the sinking fund remains untouched, about 5-15% less can be bought in the future:

[caption id="" align="aligncenter" width="756"]

Inflation loss of capital in sinking funds (c) bitcoin-risks.com[/caption]

Inflation loss of capital in sinking funds (c) bitcoin-risks.com[/caption]Look at the image above to get an idea about the loss of buying value of 100,000 USD of sinking fund savings per year when assuming only a mere 5% of real inflation, up to a probably more likely 12% inflation.

This is a real challenge for any responsible building management: how to protect our building’s savings? Money that has been saved over years is at increasing risk of losing much of its value unless it’s spent as fast as possible (which would drain the savings also, and also incentivizes ‘bad spending’ – paying for services and goods that may not really be necessary, or have worse quality than such bought after enough consideration and doing extensive calculations). Indeed, pushing ‘spending’ just because money is losing its value is usually a bad idea. Much better is to look for ways to protect the value of the money the co-owner’s community has accumulated over the years.

Luckily, Bitcoin offers a way out. It has proven itself as hard money, appreciating in value by an average 200% per year since it first hit the markets. But in this article, we don’t want to advocate for any position in Bitcoin that could be considered as too risky by anyone, keeping in mind that Bitcoin, due to it’s ongoing price discovery phases, is still very volatile and has experienced price drops of up to 80% in the past (although observers of the markets expect these price swings to become less of an issue, as short-term speculators are successively replaced by long-term holders which are buying Bitcoin for exactly the same purpose a co-owners’ community would to: value preservation.

From today’s perspective, converting 5-30% of a sinking fund into Bitcoin could be considered as reasonable and responsible (to achieve the goal of value preservation), but also as conservative enough (exposition at this percentage would be limited, so even during a very bad ‘Bitcoin year’, most of the Fiat funds would be immediately available for emergency measures).On top of that, Bitcoin offers fancy, but manageable means to control who has access to the funds – arguably even better ones than if the funds were saved in a bank! Why that?

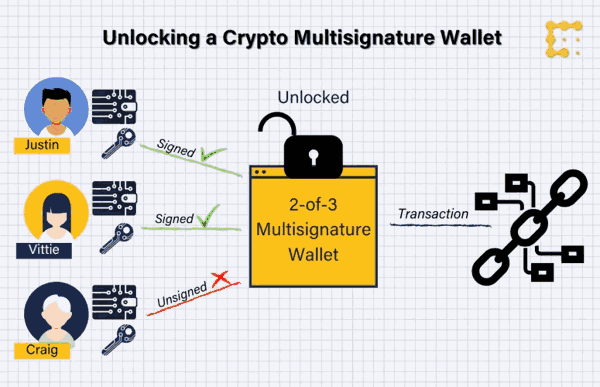

Well, Bitcoin has long supported a concept called ‘multi-signature security’ (or short: ‘multi-sig’), that allows to fine-tune access to the Bitcoin funds. To compare: often enough, a bank requires either just one or two signatories to show up at a bank to withdraw funds – or in some cases, all members of a management committee have to appear there. Obviously, the latter variant isn’t easy to organize, while only 1-2 signatories involve serious security problems if they get bad ideas – but it wouldn’t even have to be they themselves, they are simply 1-2 obvious security risks, be it for internal or external reasons. On top of that, many banks limit their damage insurance for savings accounts to a few 100k USD, if at all. So in case a condominium’s bank goes bust, so do by far most of their savings.

Bitcoin’s multi-sig system however offers to ‘share’ signatory powers between several entities: like 3 of 5, 2 of 3 or 5 of 7 for example. All it takes is for the management committee to buy Bitcoin and store them in a well-established and well-tested Bitcoin wallet like Electrum or Green Wallet. An important detail to consider with Bitcoin is that the wallets don’t hold the ‘physical’ Bitcoin, but only help to organize ‘state of the art’ key management. Imagine your ‘Bitcoin wallet keys’ as passwords that allow access to your Bitcoin on the global Bitcoin blockchain – your wallet will help you to create and to move your Bitcoin (like: from or to an ‘exchange’ that converts them from/to USD or EUR), but without the keys, the wallet is useless.

Justin, Vittie and Craig each hold one of the 3 keys needed to unlock the multisig wallet (Image: CoinDesk) Even crypto exchanges, brokers or investment funds use multi-signature storage to secure their storage funds. They distribute admin keys for their funds in order to distribute the risk; if hackers want access to their reserves, they’re going to need several keys to do so. Similarly, multi-sig ensures no one person in the condominium building, including hostile employees or other attackers, are able to unilaterally withdraw funds from the account.

It is fair to say that this opens up a new and powerful chapter in condominium buildings’ financial management. Not only can they now protect themselves from increasing loss of savings due to increasing inflation (a problem that has been of growing relevance since the introduction of quantitative easing by the FED, the ECB and other central banks), but they can also improve their safety measures related to the large savings many condominium buildings have built over the years. Granted, there is a learning curve involved as with any new technology, but it is manageable and there are plenty of services available today that can help and support.

For the purpose of keeping it somewhat concise, let’s keep it with this for now – but we may add more in-depth instructions and thoughts later on. Don’t hesitate to add your comments below – particularly if you are interested in the topic and want us to extend this article.

rektless

KeymasterChina-related scaremongering belongs to media’s most favorite Bitcoin-related ‘FUD’ it sometimes seems. While spreading rumors of imminent ‘Bitcoin bans’ or ‘mining bans’ has mostly disappeared since 2017, the dominance of mining pools based in China, which are interpreted as imminent risk for a so-called ‘51% attack’ on Bitcoin, is an evergreen. Let’s have a quick look at this and how reasonable such threat scenarios are.

Mining pools are essentially joint groups of Bitcoin miners who combine their computational resources (‘hash power’) over a network to improve the probability of finding a block to ‘win’ the finder’s reward paid in Bitcoin. The miner can then store transactions from the mempool in the new block and receive their transaction fees. According to various mining pool statistics, mining pools with their headquarters in the Greater China area are estimated to currently dominate Bitcoin’s hash power with 60%-70%, but Chinese miners – physically located in China – are estimated to only make up 32-40%. The reasons for this still relatively high dominance are probably multi fold: Chinese-based pools belong to the ‘oldest’ ones, so naturally, they accumulated numerous loyal miners around the world over time. Also, the majority of semiconductors are produced in Asia, and of course the relatively easy access to cheap sources of energy (back in the day it was mainly coal, these days the highest percentage are renewables with wind power and hydroelectric power, mainly in areas where there is massive over-supply of energy but under-supply of demand, so it’s cheap to set up mining operations in China) also gives China-based mining corporations / pools an advantage.

So let’s think of a theoretical scenario in which certain entities within ‘China’ would identify the bosses of the respective ‘Chinese’ mining pools, and strong-arm them to act against their business interests (which are to make money mining Bitcoin, and to keep up the Bitcoin price instead of causing market panic) – by collaborating for a 51%-attack on Bitcoin.

What could happen?

A 51% attack can’t attack the Bitcoin consensus (network rules), which includes no double spending, valid signatures, no introduction of more currency than allowed etc. These rules are verified by the 10,000+ active Bitcoin nodes (of which there are very few in China by the way). Bitcoin network nodes are usually run by advanced Bitcoin users around the world of which only a hand full are also mining.

A 51% attack can’t ‘arbitrarily’ steal users’ Bitcoin. Attackers also can’t make invalid transactions become valid, or change the history of Bitcoin ownership.

What a 51% attack can do is to attempt double-spending. If an attacker controls more than half of the network hash rate, he can generate blocks faster than the rest of the network. So after sending some Bitcoin to a vendor, he could send the same Bitcoin to himself and then attach them to a new ‘fork’ of the blockchain. If thanks to his hash power this forked chain becomes longer than the branch built by the honest network, the vendor would realize that his payment in fact didn’t arrive because the forked chain containing the ‘hijacked’ transfer was considered as the ‘real’ chain by the Bitcoin network.

However, the more confirmations an entity requires before accepting a payment, the higher the aggregate resource cost of performing this attack, which could make it unprofitable or delay it long enough for the circumstances to change or slower-acting synchronization methods to kick in. A majority attack was more feasible in the past when the network hash rate was much lower.

…or slowing Bitcoin down: this form of attack is not as direct as the one described before, but still capitalizes on existing mining dominance: either by technical means (like China’s ‘Great Firewall’) or by mining empty blocks, the playing field gets distorted by adding latency for other mining pools, or generally

To be fair however, a 51% attack could cause at least temporary problems for the Bitcoin network by slowing it down, triggering lots of (partially justified) ‘FUD’, and in a worst-case scenario of ongoing attacks (‘Goldfinger attack’ aka ‘pissing attack’), it may ultimately even force the developers to jump in to block the adversaries, which would put Bitcoin’s censorship-resistance into question.

But despite the likely temporary setbacks in public confidence and price development, many ‘hardcore’ Bitcoiners even wish for a governmental attack, as it would result in a high chance of the Bitcoin network becoming even more resilient and hardened to attacks as a result. Also, such an attack could result in ‘good riddance’ of bad actors in the system and a redistribution of hash-power (the individual miners would switch over to honest pools), with the network becoming significantly more decentralized than before.

What will help Bitcoin to become even more resistant against potential 51% attacks?

- Not only the increasing domination of Chinese mining pools, but also the supply shock during Covid-19 will hopefully result in more semiconductor production outside of Asia in the future. When miners start looking for new locations to establish their operations, it will improve competition and decentralization.

- With a growing number of independent entities tightly observing activity on the Bitcoin network, it becomes more difficult to perform covert attacks on the network. It’s practically guaranteed that within a matter of minutes after an attack, an alert would be sounded and miners would start looking into taking action against malicious actors.

- The juiciest target for a double spend will be an exchange. However, exchanges with adequate liquidity (making them ‘attack-worthy’) usually have withdrawal limits, require identification of customers, and on top of that, the Bitcoin that the hacker holds after the attack will be ‘tainted’ and hard to exchange.

- Improvements on mining firmware (example: BraiinOS), mining software (example: BOSminer) and the mining protocol (example: Stratum v2) are making it more difficult to pull off 51% attacks and general hacking attempts, and they allow miners to easily switch pools at any time.

On a sidenote: a 51%-attack (a.k.a. ‘majority attack’) has never been successfully executed on the Bitcoin network, but it has been demonstrated to work on some small altcoins.

What are your takes on this seemingly quite emotionalizing topic? Add a comment below if you want to share your thoughts.

rektless

KeymasterA somewhat ‘advanced’ concern – mainly brought up by people who have already read about Bitcoin and at some point are starting to ‘connect some dots’ – is the concern that Bitcoin’s security could be broken by quantum computers one day.

This is an actual risk, and it would be reckless and ignorant to deny it.

However, the question is: when would such a still theoretical risk (there are no functional and stable quantum computers that could break SHA-256 encryption which is used by Bitcoin) turn into an imminently threatening one?

The risk invoked by quantum computing would be a) that Bitcoin’s SHA-256 hashes could be solved faster than by ordinary computers / ASIC mining devices, or b) to break the public-key encryption that protects users’ Bitcoin balances. So if someone secretly had a quantum computer, he could mine Bitcoin a bit faster, or he could just steal everyone else’s Bitcoins. However, that would only work as long as a) no one knew that such a computer exists and b) no one else would use one for this purpose. Otherwise, Bitcoin’s mining difficulty would be adjusted upwards, and the advantage would be gone. But how to deal with the risk of Bitcoin getting stolen?

For this problem, the Taproot update for Bitcoin may hold a solution. More on that below.

First however, let’s take a look at how Bitcoin handles transactions. When Satoshi developed Bitcoin, public keys were the actual Bitcoin addresses themselves, so a transaction to such an address is accurately called ‘pay to public key’ (p2pk). Most bitcoins Satoshi himself/themselves had mined back in the day are stored in such addresses – a quantum computer running Shor’s algorithm (which is used to find prime numbers) could then be used to derive the private key from such an address. This would allow an adversary who has a quantum computer to spend the coins that the address had. In other words, Satoshi’s stash of ~ 1 million Bitcoin serves as a super-tasty ‘honeypot’ for anyone who were able to develop a functional and stable quantum computer that’s capable to attack the Bitcoin network!

But already at the time when Satoshi was still openly mining, the improved system of ‘pay to public key hashes’ (p2pkh) was introduced, and almost all transactions used p2pkh from then on – with these, it is extremely difficult to derive private keys from the hashes that are publicly visible in the blockchain:

A worthwhile watch to get an idea about the high security of Bitcoin’s encryption Probabilities & state of science: With research data available in 2019, the estimated time required to break SHA-256 encryption using Grover’s algorithm (the best bet there currently is to utilize a QC in order to break this encryption) was estimated at 18,000 years. According to numerous experts in the field (among them, Bitcoin Core developers who are specialized in the field, like Stepan Snigirev), Quantum computing won’t be a serious threat for SHA-256 encryption for at least 10 more years, even if we were to believe the most optimistic assumptions of corporations, universities etc. that are trying to capitalize on the hype around this new technology to attract funding. Skeptics on the other hand, consider the idea of someone being able to a) create a stable quantum computer that is b) capable of doing the advanced mathematical calculations necessary to break any form of encryption, either as a hoax or as not being realistically possible for at least 30-40 years.

Okay, but what if there’s an unexpected breakthrough?

Only coins in p2pk addresses and reused p2pkh addresses are vulnerable to quantum attacks.

So, only if you have ever used an ancient wallet that was using the p2pk address scheme (which is very unlikely), or if you – against all recommendations – have re-used (!) a Bitcoin address, your coins would be at risk … from the aforementioned 10-50 years onwards. Only once quantum computers have become very efficient and fast, they could calculate the private key of a broadcasted Bitcoin transaction and ‘override’ it in the short timeframe of 10+ minutes until it has been stored in the blockchain to a certain depth.

Consequently, the simplest form to protect your bitcoins right away is to move them to a newly generated address which you don’t share, and not to share your wallet’s xpub keys either. Top-notch safety against the unlikely worst-case scenario that an adversary has a fast, stable quantum computer AND (!) third parties are compromised (i.o.w., gaining access to the keys you have exchanged with them), would also involve avoiding opening Lightning Network channels and using hardware wallets that exchange keys with 3rd parties.

Taproot: light on the horizon.

Taproot keys (when used according to the recommendation in BIP-0341) will have considerably better quantum resistance than legacy outputs. They don’t provide 100% protection yet, but will buy the Bitcoin project more time than other crypto-based technologies have to implement PQC (post quantum cryptography*) techniques. The remaining challenge will then be to allow for a smooth transitioning process of the current system to a new one.

* It is pretty likely that within the next years, smart cryptography experts will find a solution for the inherent problems of quantum computing vulnerabilities of ALL cryptography-using applications (this would go way beyond just Bitcoin, as all entities using cryptography would be at risk: banks, credit cards, the military, nuclear plants, SSL-encryption on the Internet, many fields of science etc.), which will allow to transition to a new type of cryptography called ‘post-quantum cryptography’ (PQC) – one that will be inherently resistant to quantum attacks. These types of algorithms present new challenges to the usability of blockchains and are currently being investigated by cryptographers around the world. The pressure to develop such methods is rising along with the progress in quantum computing itself, so eventually we will see robust and future-proof blockchain applications, most likely with Bitcoin leading the field again considering all the research and money flowing into it.

Conclusion: The most rational estimation in our view is that we won’t see ‘risky’ levels of quantum technology until at least the 2030s – for now, we are still waiting for the quantum version of Moore’s law to take over for quantum clock speeds, gate fidelities, and qubit numbers… Until then, counter-measures for quantum computer attacks will make Bitcoin resilient against such attacks.

Further, more technical reads:

Goodbye, Bitcoin … hello Quantum by Silen Nahin (2019)

Why quantum computing will not break cryptocurrencies by Roger Huang (2020)

Quantum computers and the Bitcoin blockchain by Deloitte ResearchDo you have any thoughts about these concerns, the estimated timeframes or the roadmap for PQC outlined here? Please share them in the comment section… this article is subject to regular updates whenever we hear about new aspects or related developments.

rektless

KeymasterThis is basically the main sales pitch for altcoins (all the 9,000+ other coins and tokens in the ‘crypto market’): ‘Bitcoin is old tech – look at our new tech!’ 😀

The fallacy in this concern is that the Bitcoin protocol is mistaken for a software product, instead of a software protocol that ultimately solved a century-old logical problem in 2009. A software product (like an app that can add some funny shapes to photos) could be replaced by a more fancy version of itself (like in our example, another app that can provide even more shapes). Bitcoin however is no software product, but a unique invention: it is a time-chain (references: [1], [2]), it is immutable, uncensorable, sound money, but even more importantly, it solved the Two General’s Problem and thus allowed triple-entry accounting.

As with any open-source project, it has always been possible to copy Bitcoin’s code and to try to imitate its network as well. Motivated by its success, indeed thousands of imitators have been created since it’s 2009 inception (as per 03/2021: 9,300 ‘alt-coins’!!), ranging from facsimiles such as Litecoin, pointless ‘forks’ like Bitcoin Cash, to overly complex systems like Ethereum or XRP. What unites all of them is that they were never able to even remotely reach Bitcoin’s adoption, reputation for security, decentralization of both it’s network and development, independence of centralized control, immaculate conception, or network effects. All of this again increased Bitcoin’s Lindy effect, which basically means that it’s life expectancy may go well beyond our current generation at this point in time.

No doubt that altcoin creators & their marketers will continue to do everything they can think of to ‘workaround’ this head start of Bitcoin to help their own projects – often enough, this happens using ‘FUD‘ (spreading fear, uncertainty and doubt) about Bitcoin’s core qualities, technical aspects or future prospects. But their problem is hard to come by really: Bitcoin as a better form of money and accounting already exists! Bitcoin as the hardest monetary asset on this planet already exists! So they have to generate new ‘use cases’ (that no one ever asked for), to ‘improve’ particular aspects of Bitcoin’s protocol aspects (while downplaying their shortcomings and weaknesses), and often enough they also have to use little tricks to give the impression of relevance and network activity.

Millions of marketing capital flow into the generation of new altcoin projects (in other words: other attempts of creating new moneys) today – the goal is to give speculators the idea that they can ‘invest’ into ‘the next big thing’, something the world has still been waiting for, but that Bitcoin ‘unfortunately’ can’t give them. So these creations actually are software products, trying to capitalize on the innovation Bitcoin has brought and to grab a piece of Bitcoin’s cake of success.

However, because they are basically all trying to do that, in a very paradoxical way, altcoins themselves are the biggest competitors of altcoins. There are 100 competitors for every smart contract blockchain, 100 competitors for DLT-based hybrid blockchains projects, 100 for supply-chain management tokens etc., which leads to a dilution of all the money that flows into the altcoin space (while Bitcoin attracts a continuous stream of money by the people who actually understand its unique value proposal). Due to the lack of liquidity of altcoins, they are subject of ‘pumps and dumps’ and there is big competition among what are considered ‘cheap’ altcoins. Because most speculators are not even very skilled in mathematics, they think that if 1 token of a particular project is cheap, this automagically involves wide upside potential in terms of price growth. “1 Bitcoin once costed 10 cents, so logically, my coin which also only costs 10 cents / token has so much upside still!!”

These people forget however, that these projects actually don’t compete with Bitcoin anymore – but only with the rest of the ‘crypto fiat’ market, which can produce and print tokens and new projects on demand, and where one hype is only replaced by the next ones, in the ever-lasting hunt of stupid money (people who lack of deeper insight into why Bitcoin has become as successful as it is, but just repeat the marketing phrases of randomly found altcoins) for ‘insane gains overnight’. It’s basically a redistribution scheme of stupid money owned by lazy people to smart money, with most of these Bitcoin holders in Bitcoin since many years, who are capitalizing on market cycles and the reiterated altcoin pumps & dumps to accumulate more of an immutable, limited Bitcoin supply.

These people forget however, that these projects actually don’t compete with Bitcoin anymore – but only with the rest of the ‘crypto fiat’ market, which can produce and print tokens and new projects on demand, and where one hype is only replaced by the next ones, in the ever-lasting hunt of stupid money (people who lack of deeper insight into why Bitcoin has become as successful as it is, but just repeat the marketing phrases of randomly found altcoins) for ‘insane gains overnight’. It’s basically a redistribution scheme of stupid money owned by lazy people to smart money, with most of these Bitcoin holders in Bitcoin since many years, who are capitalizing on market cycles and the reiterated altcoin pumps & dumps to accumulate more of an immutable, limited Bitcoin supply.

So there won’t be ‘another Bitcoin’ – because the problems Bitcoin solves (not ‘transferring money over the Internet‘ as many misunderstand, but: introducing a completely new monetary system featuring immutability, uncensorability, a hard monetary policy, after fair initial distribution without premining or centralized ownership, without central ‘leader figures’ etc.) have already been solved by it. There is simply no need, and most certainly also no second chance for another project to achieve all that again.

Any thoughts or comments? Please, add them below!

rektless

KeymasterA ‘bubble’ by itself is nothing bad in financial markets, as long as the underlying gets attributed with actual value. It doesn’t matter where that is or who it is. Maybe this becomes clear after reading the following quote:

“If you compare a chart of USD vs Argentinian Peso, it looks the same as Bitcoin’s. If your definition is ‘up to the right is a bubble’, then the USD is a bubble in Argentina. (…)

Another explanation is: there’s just a rational flow of capital from a weaker asset to a stronger asset.”(Michael Saylor in Blockworks’ Live Webinar “The Case for Putting Bitcoin on Corporate Balance Sheets“, 03/2021)

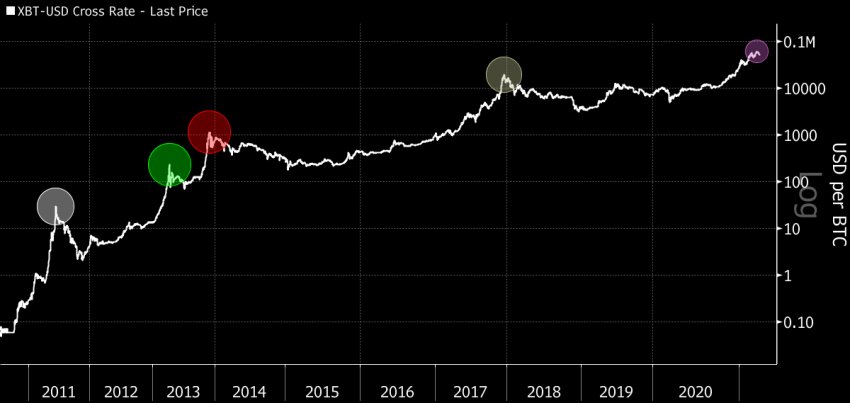

The very implication of using a bubble metaphor is to suggest it’s only a matter of time when it will pop. But there has never, ever been any asset that has staged a series of bubbles, somewhat deflated after each of them (always at a higher level than the last bubble did), and after a while regrouped to stage another bubble, the way Bitcoin has. All other bubbles on the scale of Bitcoin led to complete collapse within a year, never to return. But by now, Bitcoin’s bubble has burst four times, but never gone to zero, and then staged a comeback.

A bubble to match ‘Tulipmania’ – but not as big as four other Bitcoin bubbles in the last decade. (Image: Bloomberg) Could it ‘possibly’ be that Bitcoin is actually not in any way comparable to financial bubbles, but simply a new, sought-after asset that attracts new waves of capital, with correction phases like during typical price discovery processes? Indeed, the signs are strong and are becoming stronger every year of Bitcoin’s existence that we are witnessing the process of Bitcoin becoming a financial life-boat, fleeing the worldwide (!) devaluation of inflationary, actual fiat currency bubbles and other (price-inflated) stores of value, like bonds, pension funds, stocks, property / real estate, gold and most others.

Do you have any thoughts on that or want to add some points we’ve missed so far? Do it below, we’re looking forward to it!

rektless

Keymaster

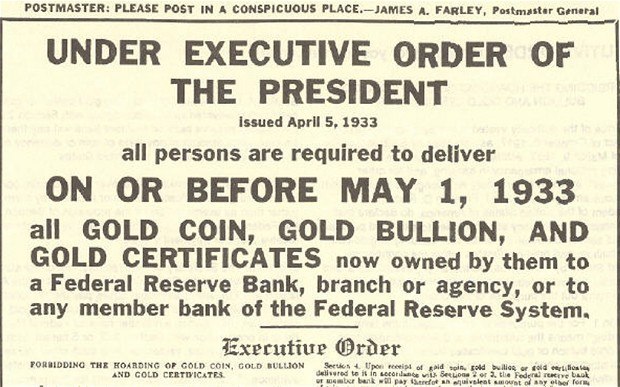

In 1933, the US government, in a desperate move to keep control over the currency, banned private ownership of gold.

The gold ‘ban’, known as ‘Executive Order 6102’ back then, existed for 31 years. The main rationale behind the order was actually to remove the constraint on the Federal Reserve preventing it from increasing the money supply during the depression.

A gold ban is comparatively easy to put into action due to gold’s physicality. It’s hard to transport (especially when trying to flee a government) or to protect. Your Bitcoin however, you will be able to ‘transport’ even just by memorizing a series of 12-24 words (the so-called ‘seed phrase‘) – and on top of that, to optionally protect them using a ‘password’ (a 25th word). That way, you can take your Bitcoin with you wherever you want, whenever you want – globally. No one even knows that you own any!

Even if governments were perfectly organized and aligned on a global level to ‘prohibit Bitcoin’ – one could still find markets or persons interested in exchanging them. All you need is the Internet, but on top of that, Bitcoin can even be transferred by satellite connections, through Mesh networks, mobile phone text messages and other means these days.

But what if mining were banned, wouldn’t that stop the ability to store transactions and to mine new Bitcoin? Indeed – the obstacle for such an intended ban to be successful is just that mining is also possible everywhere in the world (which is why Bitcoin’s distinctive superpower over other projects, it’s extremely high and multifaceted levels of decentralization, are so crucial). Even if China – where the world’s major mining pools are located – would ‘ban Bitcoin’: miners in other countries would be too happy to take over, and to mine these precious Bitcoin by themselves. Actually, for the decentralization of Bitcoin mining, such a ban by a major country would be very positive, it would immediately result in more balanced distribution of the Bitcoin hash rate!

When looking at such scenarios from a macro perspective, attacks by governments may very well even make Bitcoin stronger in the long run. Of course, a government that would somehow be able to attack Bitcoin with a lot of hash power, or by trying to block on-ramps and off-ramps for Fiat money (exchanges) would cause a shock in the markets and even the community at first. But immediately after that, all available brainpower in the community would flow right into how to work around the respective obstacles, and it is therefore very likely that a solution either already exists, or that one would quickly be found (unless things wouldn’t even smooth out by themselves, for example by a boost in p4p trading … we even have concrete examples for this: a ‘Bitcoin ban’ in Nigeria in 2021 resulted a) in a massive rise in price for Bitcoin, b) more distrust in Nigeria’s fiat currency, and c) an explosion in p4p trading activities even apart from the Internet, which reduced the governmental impact on Bitcoin trading compared instead of increasing it as intended).

Another, often underestimated factor, is that an increasing number of powerful people and system-critical corporations (like politicians, billionaires, major funds, banks, Tesla, Square and others, not just from Western, but also many Asian countries by the way) already have relevant stakes in Bitcoin, and they would be very unhappy if their governments would effectively destroy their investment.

For all the points mentioned above, the most frequent ‘attack’ vectors (if we want to call them that way) of most governments against Bitcoin is taxation today. Effectively, the government wants its share of your financial gains – most will ultimately accept that (considering that the price appreciation of Bitcoin more than covers the tax they’ll have to pay for it). What is a more serious but also increasingly frequent attack against some of Bitcoin’s fungibility & privacy properties are address disclosures / registrations (as always, with the excuse of having to fight ‘criminal abuse‘), also known as ‘KYC’ / ‘AML’.

All in all though, the means of governments to effectively ‘shut down’ Bitcoin for an ‘effective’ enough amount of time to ‘get rid’ of it are minuscule, but would turn out to be extremely costly in terms of money, their credibility, the images of their respective ‘main’ currencies and ultimately even result in an almost ‘untouchable’ image of Bitcoin as a monetary system. On top of that of course, a government ban would also destroy a country’s own opportunity to capitalize on Bitcoin’s success in the future, by making it harder to accumulate Bitcoin for their own treasury reserves. As long as Bitcoin never had to overcome a head-on attack by governments, at least all the carefully served media FUD and worries keep adoption and growth at reasonable levels.

Are there any thoughts you would like to add to this section, or do you feel we missed some important points? Either drop them directly into the comment section for further discussion, or if you want to add something to this page, feel free to submit your thoughts, and we’ll add them asap. This site can only be as good as the brain-power flowing into it! 😉 Thus, we are also looking for authors / reviewers as mentioned in the ‘About‘ page. Thank you!

rektless

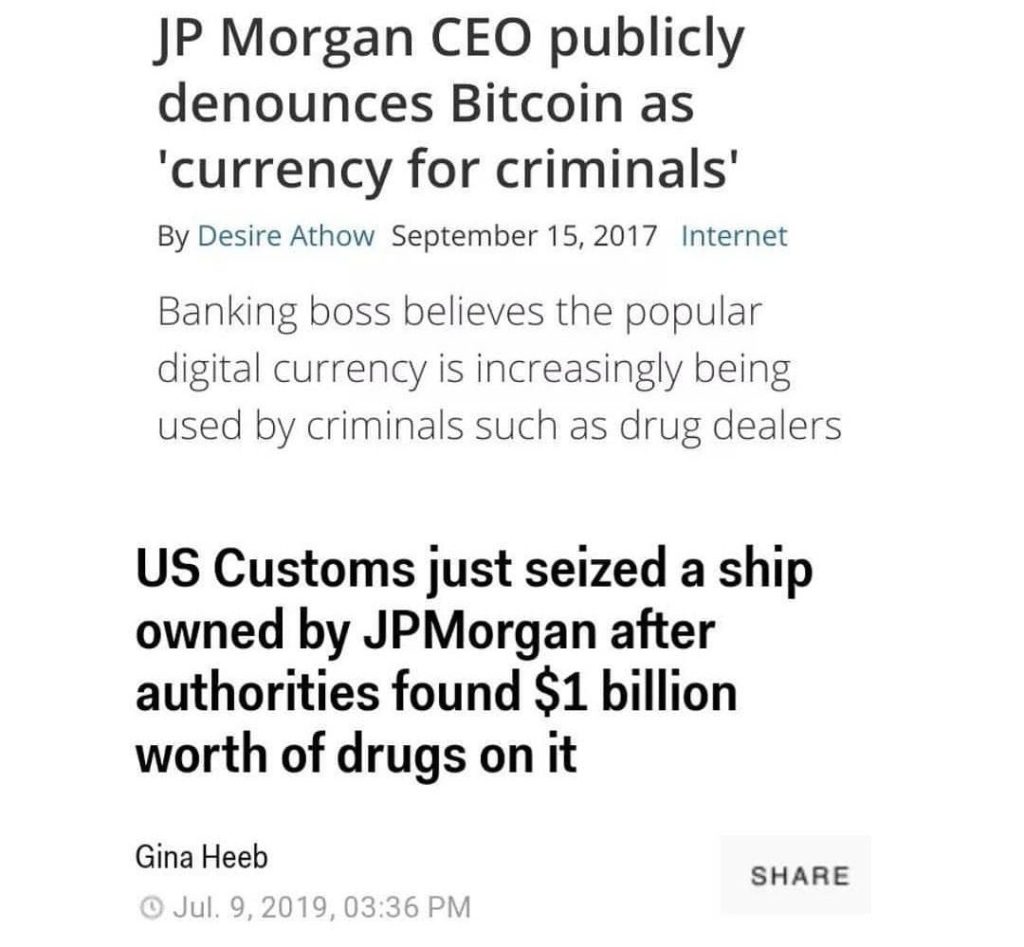

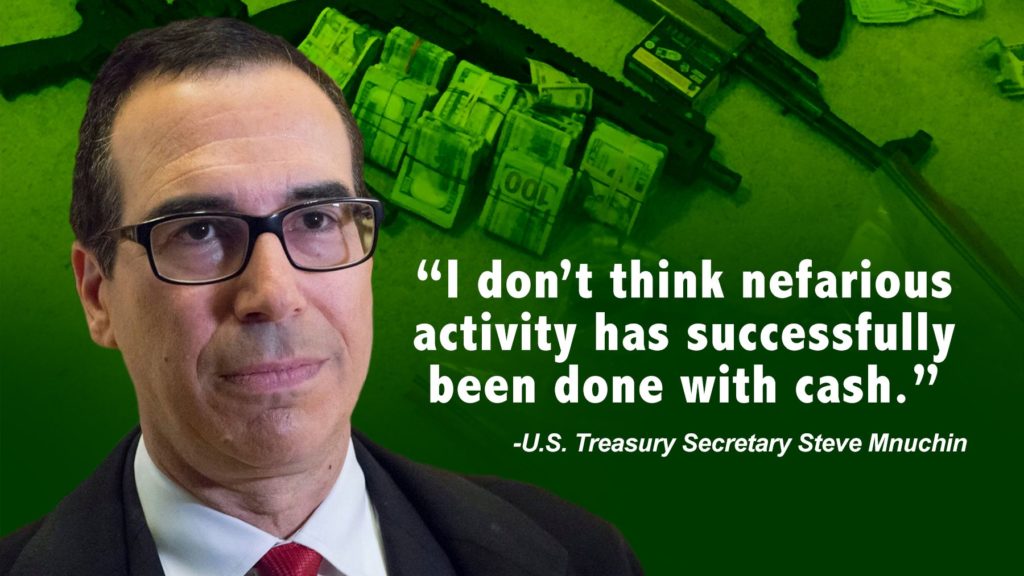

KeymasterThis is one of the most common stereotypes surrounding Bitcoin, and often also cited as a main concern of skeptics who worry that Bitcoin might become ‘illegal‘ or ‘banned by governments‘ at some point. However, it is also one of the most misguided concerns.

Yes, Bitcoin gets used for criminal activities. Just as any money does! 😉

But is Bitcoin actually used more than other moneys for criminal activities, possibly because of the ‘crypto’ aspect in it, which suggests that transactions can somehow be hidden or covered up?

Let’s take a close look at the facts:

One of the most fancy corporations analyzing cryptocurrency usage and blockchain transactions is Chainalysis, which issue a yearly report particularly focusing on illicit cryptocurrency usage (critics say: with a tendency to over-dramatize their conclusions – because a) exaggerating can make them good money, and b) who gets to define what ‘illicit’ is?).

In their latest report from early 2021, Chainalysis reports a sharp drop in total cryptocurrency-related crime to 0.34% for 2020. This equates for $10 billion in transaction volume – in 2019, what they defined as criminal activity represented 2.1% of all transaction volume (or roughly $21.4 billions worth of transfers). These figures include cryptocurrency addresses used by dark markets, ransomware actors, hackers, and fraudsters.

You may be surprised by these low numbers – but for Bitcoin, they’re actually even significantly lower (according to CipherTrace, another blockchain analysis company, a mere $3.5 billion worth of money were sent over ‘criminally associated bitcoin addresses’ in 2020). Keep in mind that Bitcoin is just one of approximately 8,000 cryptocurrency projects. Most of these projects are irrelevant and have little to no actual use, but then, this can make some of them even more enticing for criminals to cover activities like money laundering etc., all while Bitcoin gets the heat, although it has been tightly monitored with jealous watch since day 1 of its existence.Bitcoin is not even very ‘practical’ for criminals, as its transactions are just pseudonymous: every transaction is transparent on the blockchain, and it’s comparatively trivial to follow the chain of transactions from senders to receivers. Privacy-focused cryptocurrencies are arguably way better fits to be used for ‘illegal’ activities. So depicting Bitcoin of all cryptocurrencies as being popular among criminals to cover up their activities or to launder their money is pretty far-fetched. These criminals would have to be pretty stupid to use Bitcoin!

But hmm… if not Bitcoin, what do criminals actually use?

Banks, governmental figures, and fiat money / ‘physical’ cash!

Let’s take a look at their respective numbers for a comparison:

Based on a study conducted by the United Nations (UN), a report by the FATF, ‘criminal proceeds’ (funds generated by drug trafficking and organized crimes) amounted to 3.6% of global GDP, with 2.7% (or USD 1.6 trillion) being laundered. This about matches with a report by the International Monetary Fund (IMF), stating in 1998 that the aggregate size of money laundering in the world could be somewhere between two and five percent of the world’s gross domestic product. Using 1998 statistics, these percentages would indicate that money laundering ranged between USD 590 billion and USD 1.5 trillion!

The FATF states that these estimates should be treated with caution and may be higher: ‘Due to the illegal nature of the transactions, precise statistics are not available, and it is therefore impossible to produce a definitive estimate of the amount of money that is globally laundered every year.’

Not only because of that it is safe to assume that the amounts of USD and EUR transactions connected to illicit activities are probably considerably higher. Let’s not forget that simply because of the multiplied amount of US Dollars the FED and ECB have put into circulation during the last years the ‘illicit’ totals will most likely also have multiplied – while the Bitcoin transactions associated with ‘criminal’ activities are current – and still only make up a small fraction of the old numbers (!) published by the IMF and UN.

Compare this mess with the Bitcoin blockchain, which was only used for a ridiculously tiny fraction of ‘illegal’ USD/EUR transactions, but on top of that, is accountable and verifiable!

This displays the most ridiculous point in depicting Bitcoin as a risk to cover up illegal activities. Banks help to launder trillions of dollars and Euros per year – a public ledger would be their worst nightmare. Accountability…

Just a few concrete examples to illustrate the point:

Recent fines (which usually just a small fraction of the actual amounts these banks made with illicit transactions), in this case, just for the laundering of money (IOW, not including other criminal involvements):

- Wachovia $160m

- ING $900m

- Bank of Australia $700m

- Deutsche Bank $670m

- City Group $237m

- Standard Chartered $967m

- Commerzbank $1.45bn

- HSBC $1.9bn

- JP Morgan $2.05bn

- Goldman Sachs $9.6 billion (that took them 20 years though)

And they all used US Dollars and Euros – not Bitcoin.

Did I miss something or is there anything you’d like to add? Please share in the comment section, thank you!

rektless

KeymasterThis take – commonly called ‘unit bias’ – is probably one of the most common misconceptions of people hearing about Bitcoin for the first time, but shockingly, even of many who have been active in the ‘crypto space’ for quite a while!

The cause of this misunderstanding basically comes down to a mathematical fallacy. Let’s take a look at the following entry prices by 2 investors. Person A buys 1 ‘full’ Bitcoin at the price of $1,000 back in 2017, while at the same time, Person B only buys 1/10 of a Bitcoin (that’s 10,000,000 ‘satoshis’ – 1 Bitcoin can be divided into 100 million of these smaller units, similar to the ‘cents’ in the US dollar currency):

2017 $ 1,000 ROI ann.return $ 100 ROI 2018 14,244 1,324% 1,424% 1,424 1,324% 2019 4,093 309% 202% 409 309% 2020 7,462 646% 195% 746 646% 2021 30,323 2,932% 234% 3,032 2,932% Annual returns of buying 1 Bitcoin vs only 0.1 Bitcoin (BTC) Do you notice anything?

Yep – the returns are identical! 😀

Regardless how many “fractions” of a Bitcoin you buy – you can ride with its success 1:1.

But you can fine-tune how much of your savings you want to protect by converting it from inflationary Fiat money into sound Bitcoin.

Do it responsibly nevertheless. Today, an investment in Bitcoin can be considered as pretty safe compared to a few years ago, but still: only ‘bitcoinize‘ an amount of Fiat money that you can afford to hold without selling it for at least 2-3 years. That’s still way safer than ‘betting’ on the success of some random altcoin project (that may formally give you more ‘tokens’ per $100, which might play with your psyche a bit – but usually the annualized gains per invested $100 are significantly smaller, especially on a long-term scale).

Financial experts as well as experienced cryptocurrency market veterans recommend the following:

- Decide which amount of your Fiat money you can comfortably put into ‘crypto’ – in other words, ask yourself which amount you can commit yourself to keep untouched for at least a few years. You want to give Bitcoin time to ‘keep its promise’ after all…

- Allocate the majority of this ‘crypto’ portfolio in Bitcoin (at least 85%), avoid more exposure in altcoins. Altcoins are comparable to high-stake Casino bets with very little chance to succeed in the long run. Bitcoin is usually the ultimate life-saver of any ‘crypto’ portfolio, so just make sure it’s large enough to be able to fulfill this function. A large altcoin allocation will most likely cause your portfolio to bleed heavily during bear markets.

So if you are worried about investing in ‘crypto’ in general, simply bet only on the safest horse in the race, only ‘bet’ on it as much as you feel comfortable to put aside for a long time, and then really stick with it (even through bear markets) – instead of throwing in the towel if the hoped-for ‘super gains’ don’t materialize right away. 😉